NVIDIA ($NVDA) just hit a milestone that few could have imagined even a year ago: a $5 trillion market valuation. It's a defining moment that cements the chipmaker's role as the backbone of the AI revolution.

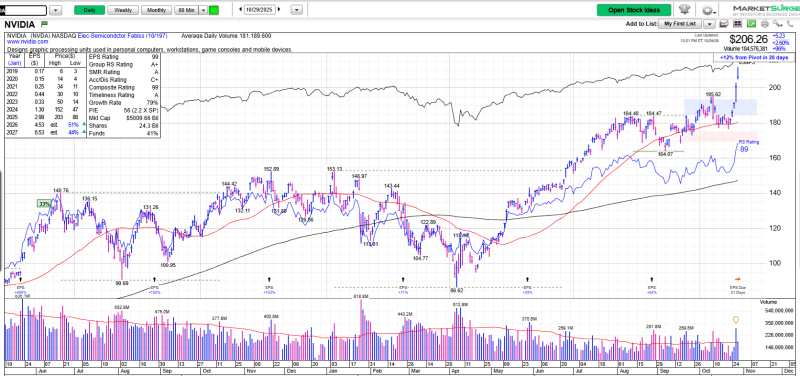

NVIDIA's Chart: Strength with a Warning

But as technical analyst @MarkNewtonCMT pointed out through @IBDinvestors and @MarketSurge, this remarkable surge is masking something important—the rest of the market isn't keeping up. While NVIDIA climbs higher, market breadth is deteriorating fast. The chart still looks strong, but there are growing signs that a healthy pullback or consolidation phase might be around the corner.

As of October 29, 2025, NVIDIA closed at $206.26, up 2.60% on heavy volume of over 184 million shares. The stock has climbed 12% above its pivot point in just 28 days—a sign of serious institutional interest, but also a potential red flag for overextension. With an RS Rating of 89, NVIDIA remains a clear market leader, but its near-vertical climb above both the 50-day and 200-day moving averages leaves very little margin for error.

Here's what the chart is telling us:

- Support Zone: $180–$185, the base built in September that could act as a safety net

- Resistance Ahead: $210–$215, where profit-taking could kick in

- Trend Status: Higher highs and higher lows since May—momentum still intact

- Volume Signals: Multiple high-volume breakouts show strong demand, but also rising volatility

- Overbought Conditions: Momentum indicators are flashing warning signs, though no reversal has been confirmed yet

- Market Breadth Problem: NVIDIA is lifting indexes while most stocks are flat or falling—a classic divergence that often precedes rotation or correction

The parabolic move since mid-October mirrors earlier breakout cycles, but at this stage, the risk-reward balance is tilting toward consolidation rather than continued acceleration.

The Hidden Weakness Beneath the Surface

Summed it up perfectly: NVIDIA is "camouflaging the performance of the broader market." Mega-cap giants like NVDA, Microsoft, and Apple are driving the indexes to new highs, but most stocks aren't participating. This kind of narrow leadership—where a handful of names do all the heavy lifting—often signals trouble. Breadth indicators across the NASDAQ and S&P 500 have weakened significantly, revealing fragility hiding beneath the headline numbers.

NVIDIA's fundamentals remain exceptional. With a P/E ratio of 56 and EPS growth near 79%, the company continues to dominate AI chips and data center hardware, posting record earnings quarter after quarter. Analysts expect another 44% EPS increase through 2026–27. But here's the catch: extreme valuation expansion, accelerating price momentum, and weakening market breadth have historically led to short-term consolidation—even for the strongest stocks. The $5 trillion milestone is symbolic of both NVIDIA's centrality to the market and how dangerously concentrated that performance has become.

In his tweet, warned: "Short-term in need of consolidation, but tough to get too bearish with this over 195. Expect the unexpected in overbought-land." That's a balanced take. As long as $195 holds, the uptrend stays intact. But with momentum oscillators deep in overbought territory and divergences appearing between NVIDIA's strength and the broader market, we could be looking at a pause or rotation—not necessarily a collapse.

The Bigger Picture: AI Infrastructure and Concentration Risk

NVIDIA's record valuation isn't just a market story—it reflects AI's evolution into core economic infrastructure. Data center demand is at all-time highs, enterprise AI adoption is accelerating across industries, and NVIDIA has become the go-to proxy for the entire AI economy—much like Apple once symbolized the mobile era. But that kind of concentration comes with risks. When one company represents over 15% of total U.S. tech market value, even a modest pullback can send shockwaves through portfolios and indexes. The strength is undeniable, but so is the vulnerability.

Usman Salis

Usman Salis

Usman Salis

Usman Salis