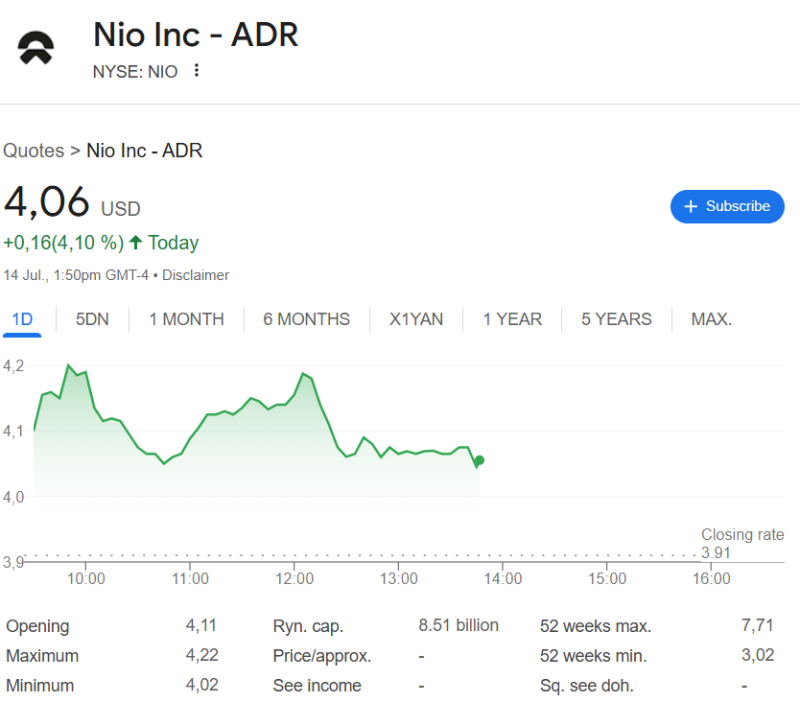

Nio Inc. (NIO), the Chinese electric vehicle (EV) giant, is once again under the spotlight as traders and investors debate its current valuation. While short sellers remain active, some market participants argue that the stock is trading far below its fair value, with a potential rally to the $7 level.

NIO Stock Price Faces Short Seller Pressure

Nio's stock price remains stuck near the $5 mark, held down by ongoing short-selling activity. Despite this, bullish voices in the trading community argue that the company’s fundamentals tell a different story.

They claim that the stock is significantly undervalued, especially considering Nio’s progress in international markets, battery technology, and cost optimization efforts.

Bullish Target Set at $7 With Long-Term Upside

Optimistic investors believe that once Nio reaches profitability, the stock’s upside could accelerate quickly. The $7 level is seen as a near-term milestone, but some suggest that the long-term value could be substantially higher.

Analysts highlight that as EV adoption rises globally, Nio’s unique positioning in the market could help unlock strong returns for shareholders.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah