The electric vehicle sector is heating up, and NIO is making waves with some pretty ambitious plans. The Chinese EV manufacturer has just thrown down the gauntlet with a massive delivery target that's got investors paying attention. With weekly registration numbers showing real strength, there's growing buzz around whether NIO can actually pull off what many consider an aggressive goal for the final quarter of 2025.

NIO Price Momentum Gains on Rising Registrations

China's EV market is on fire right now, and NIO is positioning itself for what could be its biggest quarter ever. The company just announced they're shooting for 150,000 deliveries in Q4 2025 – that's roughly 11,700 cars every single week.

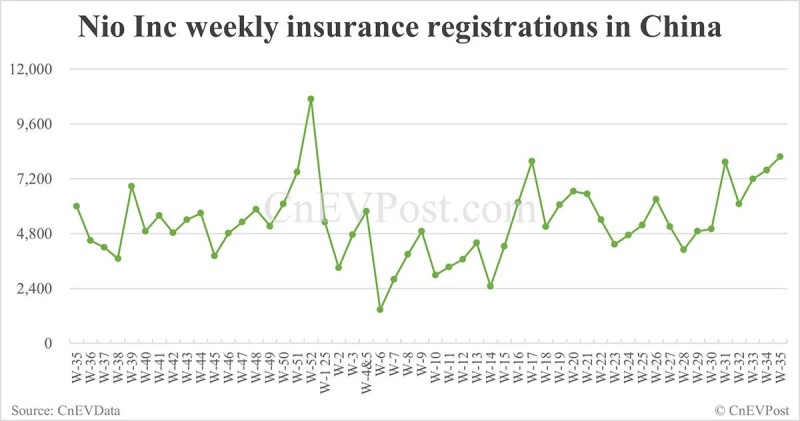

Market analyst @BrianTycangco highlighted some encouraging signs, noting that NIO hit around 7,000 weekly registrations in August and has since pushed above 8,000 in recent weeks. The insurance registration data is backing this up, showing that real consumer demand is there.

Can NIO Achieve 150K Deliveries in Q4?

Looking at CnEVPost's chart data, NIO's weekly insurance registrations in China are showing a clear upward trend. After some bumpy periods earlier this year, things have turned around with a strong rebound that's giving the company confidence in their big target.

If NIO can keep this momentum going and hit that 11,700 weekly registration mark in Q4, we're talking about potentially one of their strongest quarters ever. That kind of performance could really boost NIO's stock price as investors start factoring in higher revenue potential.

The road ahead isn't easy though. Tesla and BYD are fighting hard for market share in China, and the whole EV industry is dealing with slower global demand and price wars.

But NIO's registration numbers show they're holding their own. With solid brand recognition and growing adoption, analysts think NIO might just surprise everyone on the upside. For investors watching the stock, it all comes down to whether the company can turn these registration gains into real deliveries and revenue growth.

Usman Salis

Usman Salis

Usman Salis

Usman Salis