Chinese electric vehicle manufacturer NIO has reached a significant operational milestone in its Q2 earnings report. The company demonstrates that growth no longer requires proportional increases in administrative spending, while simultaneously achieving profitability in previously cost-heavy service segments. This development suggests NIO is maturing from a cash-burning startup into a more efficient automotive business.

NIO Price Sentiment Strengthened by Report Highlights

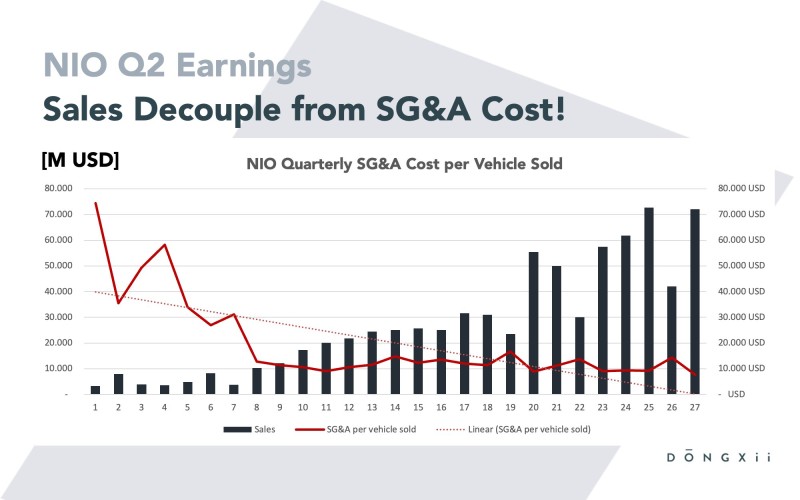

The earnings data shows NIO's Sales & Marketing costs per vehicle dropping substantially. Where the company previously spent over $70,000 per car in administrative costs, this figure has steadily decreased even as delivery volumes reached new highs. This trend demonstrates improved operational leverage as NIO scales its business.

Market analyst noted this cost-sales decoupling could signal the start of a sustainable growth phase. For investors watching NIO's stock performance, this efficiency gain represents a positive development that should translate into better profit margins going forward.

Services and Subscriptions Drive Net Positive Contribution

Beyond vehicle sales, NIO now generates profitable revenue from its service ecosystem, including battery swapping stations, lifestyle merchandise, and subscription offerings. These previously loss-making segments have turned the corner and now contribute positively to the bottom line.

This revenue diversification reduces NIO's dependence on pure vehicle deliveries for growth. The additional income stability could help smooth out the typical volatility seen in EV market cycles.

Key Takeaways for NIO (NIO) Price

- SG&A per vehicle sold: Declining trend improves cost structure

- Sales growth: Strong momentum independent of cost pressures

- Service revenues: Battery swapping and subscriptions now profitable

- Market outlook: Enhanced efficiency plus diversification support bullish sentiment

NIO's Q2 results mark a turning point toward operational maturity. With administrative costs falling and service revenues turning positive, the company appears positioned for more sustainable growth in future quarters.

Usman Salis

Usman Salis

Usman Salis

Usman Salis