NIO's new ES8 launch created quite the stir online. A viral Weibo post claimed the premium SUV had already racked up 100,000 pre-orders with a jaw-dropping 90% conversion rate. Investors got excited, social media lit up, and everyone started talking about NIO's comeback story. But then reality crashed the party when a top company executive decided to set the record straight.

Yang Bo Sets Things Straight

Yang Bo, a key NIO executive, wasn't having any of it. He jumped on Weibo to shut down the speculation, making it clear the company won't be publishing booking numbers anytime soon. His message was blunt: "We should not cheat ourselves to make false prosperity." Instead of chasing headlines, he said NIO's real priority should be nailing the basics - quality customer service and solid test-drive experiences.

This directly contradicted the buzz that accounts like Steve-DOGE-NIO had been amplifying. Yang Bo's intervention shows NIO wants no part in feeding the hype machine, at least not with unverified numbers.

Why This Matters for the Stock

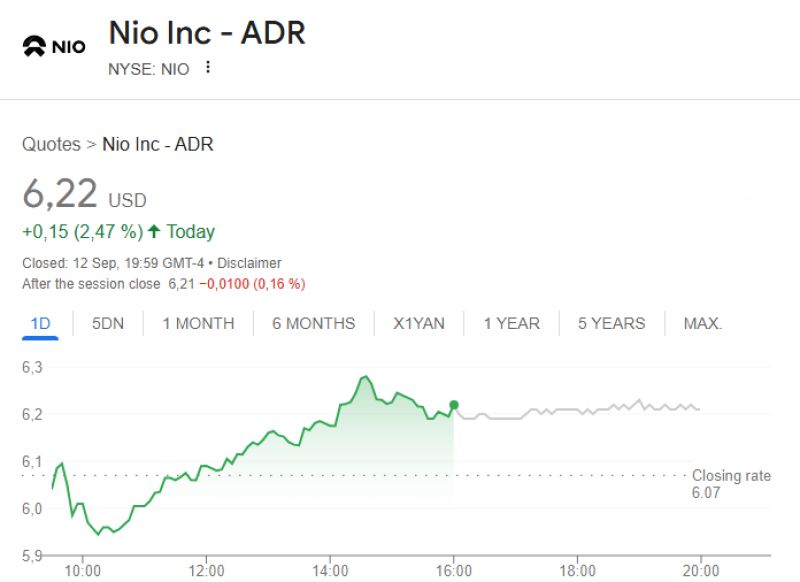

The chart tells the whole story - NIO shares have been ping-ponging between excitement over new products and worry about the company's finances. EV enthusiasm runs deep in China, but the stock keeps hitting resistance at recent highs. That's classic behavior when reality doesn't match the rumors.

Here's the thing about EV stocks: they're incredibly sensitive to perception. Traders love pricing in aggressive growth stories, but when company executives pour cold water on the speculation, corrections usually follow. Yang Bo's comments are a perfect example of how quickly sentiment can shift.

The Bigger Picture

The ES8 isn't just another car for NIO - it's supposed to be a cornerstone of their premium strategy and a key weapon in China's brutal EV war. With Tesla, Li Auto, and BYD dominating the conversation, NIO needs wins. The pre-order rumors fed perfectly into investor hopes for a turnaround, even without solid data backing them up.

Yang Bo's reality check might sting in the short term, but it could actually help NIO's credibility long-term. Instead of chasing viral moments, investors will need to focus on what actually matters: real delivery numbers, profit margins, and how well the company executes its overseas expansion. Someti

Usman Salis

Usman Salis

Usman Salis

Usman Salis