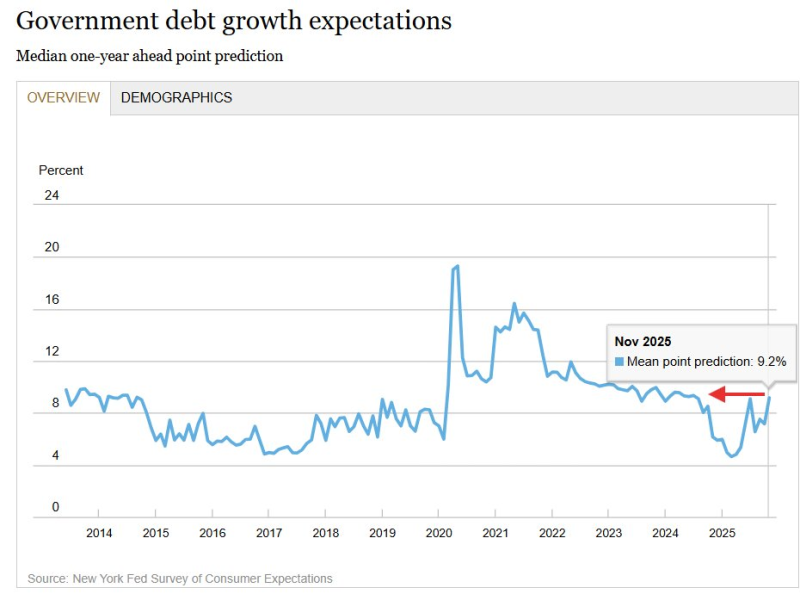

⬤ Americans are bracing for bigger government debt growth, according to the newest New York Fed Survey of Consumer Expectations. Consumers now think U.S. debt will expand by 9.2% over the coming year, marking the highest level since July 2024. The data shows expectations have been climbing steadily through late 2024 into 2025 after dropping to historic lows earlier in the year.

⬤ Back in March, the same survey hit a record low of just 4.6%—the lowest reading since the survey started tracking this metric in 2013. That didn't last long. The trend reversed course and has been moving higher ever since. The chart shows previous spikes during the 2020–2021 pandemic period before settling down, but now expectations are creeping back up again.

The 9.2 percent mean point prediction for November 2025 underscores a clear uptick in expectations compared with earlier 2024 levels, according to the survey data.

⬤ This matters because what people expect about debt growth can shift how markets feel about fiscal health, where long-term interest rates might head, and overall risk around the USD. When expectations for debt expansion rise, it usually feeds into bigger conversations about deficits, how much the government needs to borrow, and what policymakers might do next. Traders will be keeping an eye on future releases to see if these expectations level off or keep climbing as the economy changes.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova