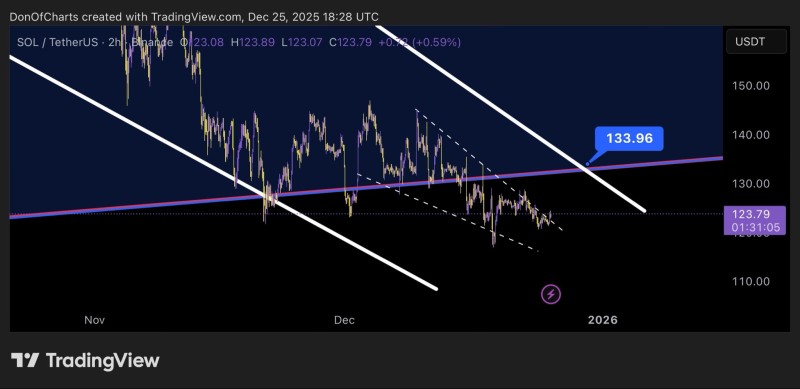

⬤ Solana (SOL) is hovering around $123.79 on the SOLUSDT pair as fresh technical analysis points to a possible breakout from a falling wedge pattern. The immediate target sits at $133, and if SOL can reclaim that level, traders expect momentum to pick up. The chart, based on a two-hour timeframe, shows the token sliding lower through a tightening downward channel before stabilizing near the lower edge toward the end of December 2025.

⬤ The $133 level is the first major checkpoint for Solana. The analysis suggests that once this zone is secured, price could "magnet" toward $206 and eventually $300. The chart layout backs this up with angled white trend lines showing the broader down channel, dashed lines marking the falling wedge, and a magenta trend line underneath that lines up with the reclaim zone.

⬤ Right now, Solana is still trading below the $133 mark but has started consolidating more tightly inside the wedge. This comes after weeks of downward pressure starting in early November, where SOL couldn't hold onto multiple recovery attempts. A clean break above the wedge resistance and a reclaim of $133 would signal a shift toward short-term bullish momentum and set up what could be a strong continuation move.

⬤ This matters because Solana remains one of the most actively traded altcoins, and clearly defined levels like $133, $206, and $300 can shape market sentiment. A confirmed breakout could influence trading behavior across the crypto market, while failure to reclaim these zones might keep SOL stuck in its recent downtrend.

Peter Smith

Peter Smith

Peter Smith

Peter Smith