NIO traders got caught in a liquidation storm this week as the stock struggled to punch through the $8 price level. A heatmap of the order book showed massive sell walls stacked up right where bulls needed a breakout, and the result was predictable: a cascade of forced exits that wiped out leveraged positions in minutes.

Why the Liquidation Happened

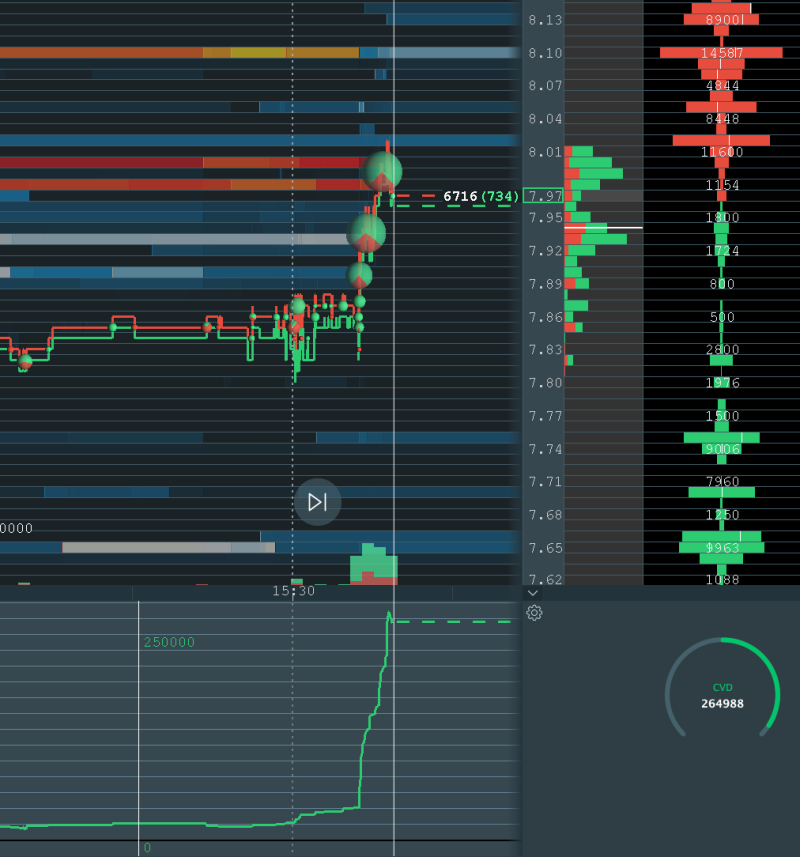

According to analysis from Pax, large sell orders piled up between $7.95 and $8.10, essentially creating a ceiling that absorbed all the buying pressure. When price couldn't break through, the leveraged longs got liquidated in a chain reaction. The $8.00–$8.10 zone is now clearly the line in the sand, backed by real liquidity. Below that, there's some cushion with buy orders sitting around $7.70 and $7.62. The cumulative volume delta spiked hard before collapsing, which is textbook liquidation behavior—lots of volume, but no sustained follow-through.

This kind of event shows just how fragile things get when too many traders are using leverage on a stock that's already bouncing around. Liquidations might feel brutal in the moment, but they also clear out the weak hands. If NIO can actually get above $8 and hold it, there's room to run toward $9 or even $9.50. But if it gets rejected again, we're probably heading back down into the same old range.

Conclusion

The recent shakeout around $8 is a reminder that resistance zones matter, especially when leverage is involved. Keep an eye on that $8 level—if NIO breaks through cleanly, momentum could pick up fast. If not, expect more chop and possibly another leg down.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah