NIO stock is heating up again. After climbing steadily for weeks, the Chinese electric vehicle maker is taking a breather - and that might be exactly what bulls want to see. Technical traders are eyeing this cooldown as the perfect launch pad for what could be a monster rally toward $9 and potentially beyond.

Chart Breakdown Shows Clear Path Higher

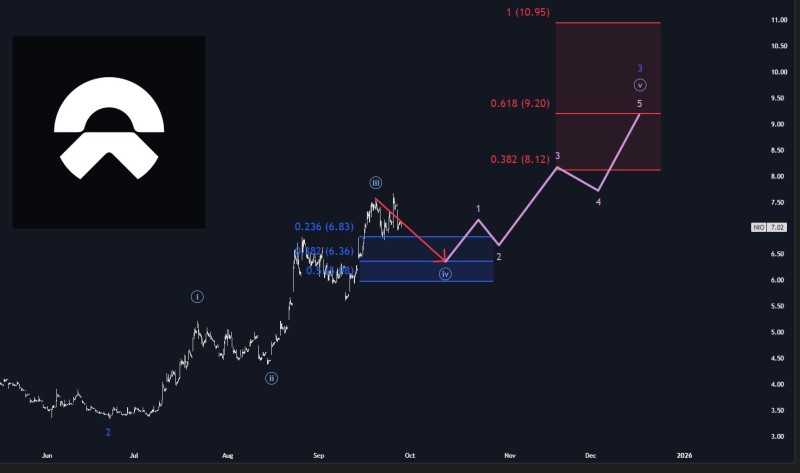

The buzz started when trader The Analyst laid out a compelling case using Elliott Wave analysis. The setup is clean:

- Entry Point: $6.36

- Stop Loss: $5.90

- Profit Target: $9.21

That's roughly 50% upside if everything plays out right. Not bad for a month's work.

The technical picture is telling a pretty convincing story. NIO just wrapped up what looks like a strong third wave rally and is now in that typical cooldown phase that often precedes the next leg up. The expected bottom around $6.36 hits right where you'd want it - perfectly aligned with those key Fibonacci levels that traders love to see.

If the momentum keeps up, we're looking at $8.12 as the first major target, then $9.20 if things really get cooking. And for the really optimistic crowd? There's talk of $10.95 if this thing gets serious legs under it.

Why NIO Is Getting Attention Again

There's more than just chart patterns driving interest here. The technical setup shows NIO building higher lows and bouncing strong from support zones - that's the kind of price action that gets swing traders excited. Plus, NIO still carries weight as one of China's flagship EV brands, and there's growing appetite for these high-beta plays when traders want to make quick gains.

The sector backdrop isn't hurting either. Electric vehicle demand continues growing, and NIO's brand recognition in China gives it an edge that pure-play startups don't have.

Look, no trade is guaranteed, and NIO comes with its fair share of risks. But if you're looking at this setup purely from a risk-reward perspective, it's hard to argue with the math. As long as NIO can hold that $6.30-$6.40 support zone, the door to $9 and higher looks pretty wide open. For swing traders willing to take the heat, this could be one worth watching closely.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah