⬤ NIO is back on traders' radars after a notable shift in market sentiment. What was once considered "too expensive," then "too cheap," is now being viewed as still undervalued despite recent price recovery. The renewed optimism stems from improving sales figures and growing confidence that the company could be nearing profitability. Bulls are betting that the current price doesn't fully reflect where NIO is heading.

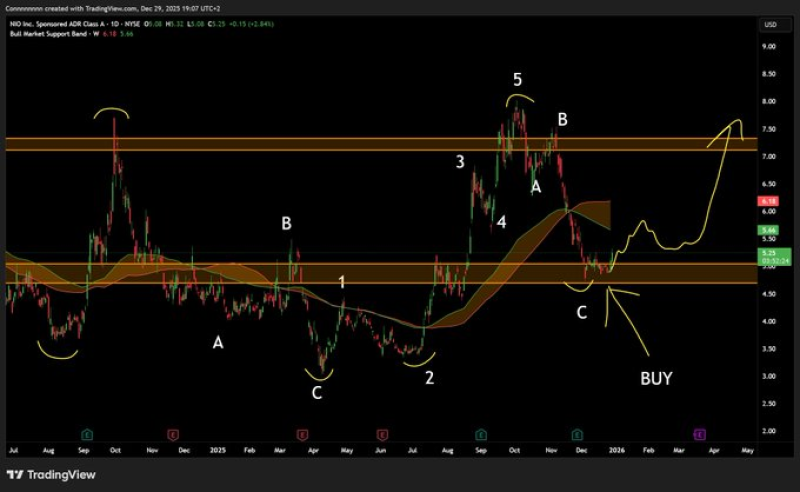

⬤ Delivery numbers keep climbing for NIO, which is fueling much of the positive outlook. Strong policy backing from China adds another layer of confidence for investors eyeing the company's long-term potential. Technical analysis shows the stock bouncing off support levels, with chart patterns suggesting room for further upside from here.

⬤ The stock has been through a full sentiment cycle—falling when deemed overpriced, recovering when seen as a bargain. Now, supporters argue that even after stabilizing, NIO is trading below fair value. With profitability reportedly within reach and sales trending upward, the case for holding or buying is gaining strength among those tracking the name.

⬤ NIO's evolving story comes as the market watches EV makers closely, weighing delivery growth against broader economic conditions. If the company can deliver on profitability expectations while maintaining sales momentum, sentiment could continue building, keeping NIO front and center as its turnaround narrative unfolds.

Usman Salis

Usman Salis

Usman Salis

Usman Salis