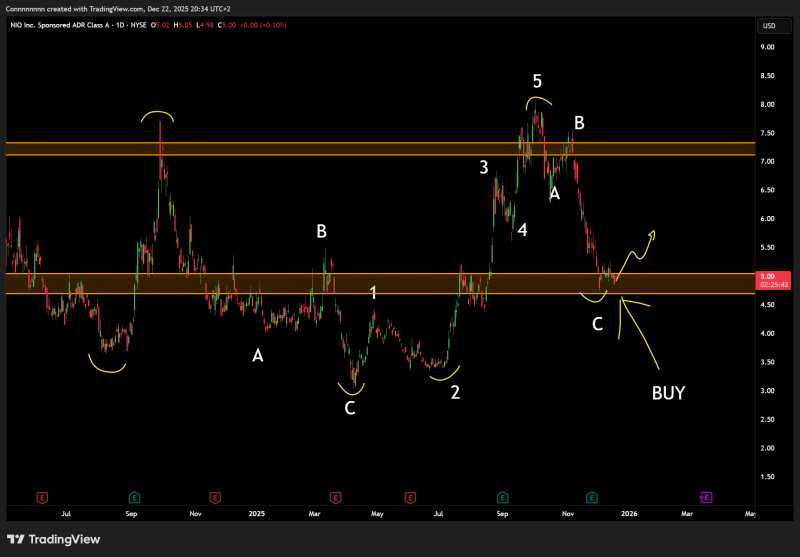

⬤ NIO Inc. is currently trading near the $5 mark, a price level that's acted as a floor multiple times over the past few cycles. The daily chart shows the stock grinding sideways after a brutal selloff, with recent price action much calmer compared to the sharp drops seen earlier. According to analyst observations, the consolidation phase suggests the market is catching its breath rather than gearing up for another leg down.

⬤ Looking at the bigger picture, NIO has repeatedly bumped into resistance between $7 and $8 before sliding back down to this same support area. The recent candlesticks show tighter movement and less selling pressure, which typically happens when a stock finishes a major correction and starts building a base. It's the kind of pattern that forms when sellers are exhausted but buyers aren't quite ready to step in aggressively yet.

⬤ The chart structure points to a completed corrective wave, with the stock now sitting at a historically attractive entry zone for buyers. That said, there's no confirmed reversal signal yet, just price stabilizing after forming a series of lower highs and lows. The technical setup keeps the door open for an eventual move higher, but it's going to take time and sustained holding above current levels.

⬤ What makes this moment significant is that extended consolidation at long-term support often marks a turning point for future direction. If NIO can hold above $5 and build momentum, the upside scenario stays in play. A breakdown below this level would flip the script and raise concerns about another downturn. For now, it's a waiting game as the stock works through its base-building phase.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi