Microsoft's stock has shaken off its recent correction and is back on track, climbing sharply from a critical support area that technical analysts had been watching closely. The rebound validates the bullish Elliott Wave pattern and suggests the tech giant might be gearing up for another major leg higher—potentially toward the $600 mark.

What the Chart Is Saying

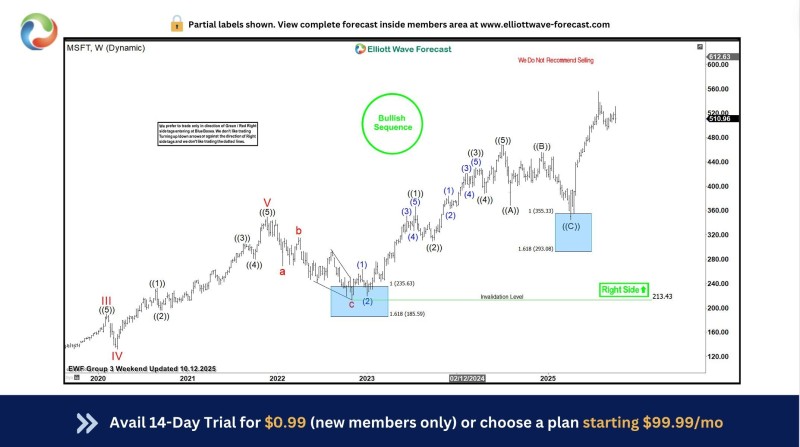

Weekly Elliott Wave analysis shows Microsoft completing a classic A–B–C correction in what's called the "blue box" zone, which sits between $293 and $355. This area acted as a strong accumulation point, and the bounce from there has kicked off a fresh upward wave. The chart is labeled "Right Side Up," meaning the trend is bullish and there's no reason to bet against it right now.

Here's what stands out:

- Wave Structure: The correction is done, and a new impulse wave is underway

- Fibonacci Support: The $293 level lines up with the 1.618 Fibonacci extension—a historically reliable turning point

- Bullish Momentum: Price has pushed past $355 resistance and is now targeting the $600–$612 range

- Safety Net: As long as the stock stays above $213.43, the bullish outlook remains intact

Why It Makes Sense

The technical picture aligns nicely with what's happening inside the company. Microsoft's recent earnings showed explosive growth in Azure AI and solid traction from its Copilot tools. Investors are buying in, and that confidence is showing up on the charts. It's one of the few mega-cap tech stocks managing to hold both momentum and clear growth prospects.

The setup points to more upside ahead. If Microsoft holds above $293, the path toward $600 looks open. Sure, there might be some short-term dips along the way, but those are likely to be seen as buying opportunities rather than warning signs. As put it, this is a "buy-the-dip" structure—not a time to short.

With the chart and fundamentals both pointing in the same direction, Microsoft looks poised to make another run at record highs.

Peter Smith

Peter Smith

Peter Smith

Peter Smith