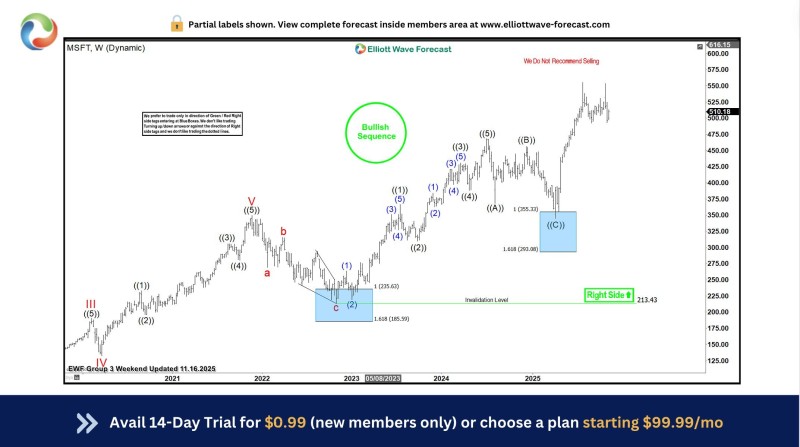

⬤ Microsoft's stock is showing renewed upward momentum after bouncing from a key support zone identified by Elliott Wave analysts. MSFT moved sharply higher from the highlighted blue box region, which typically marks an area where buyers re-enter the market. The chart suggests Microsoft is maintaining its broader bullish sequence, staying above previously noted invalidation levels.

⬤ The chart shows Microsoft recently completed a corrective wave structure before accelerating upward, with the blue box area between earlier wave counts signaling a potential reversal point. This region was associated with a retracement targeting the 1.618 Fibonacci zone, where analysts typically expect bullish reactions. MSFT has since moved higher toward the $510 area, continuing the long-term uptrend shown across multiple weekly cycles. The upward reaction aligns with the larger impulsive pattern that's guided Microsoft's trend since late 2023.

⬤ The broader pattern also shows a clear right-side tag, indicating the dominant market bias remains upward within the Elliott Wave framework. The chart includes a note stating that selling is not recommended, highlighting that MSFT remains positioned within a bullish structural environment. The sequence of higher highs and higher lows across the wave count further supports the view that Microsoft is still tracking upward momentum despite recent corrections.

⬤ This matters because MSFT continues to be a key driver of strength in the technology sector, and its renewed upward structure reinforces confidence across the broader market. The strong reaction from a well-defined support area suggests sustained demand even after corrective movements, showing the resilience of Microsoft's long-term trend. With the bullish sequence intact, MSFT's performance may continue influencing expectations for the tech sector and broader market sentiment in the coming weeks.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah