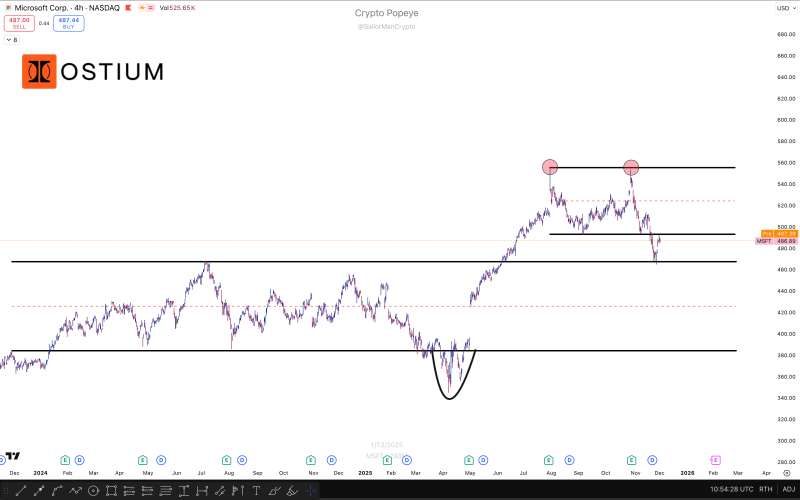

⬤ Microsoft is facing significant technical pressure on the 4-hour chart after getting rejected twice near all-time highs and breaking through a major support zone. The stock formed a textbook double top pattern before losing its range low, which has shifted the near-term outlook decidedly bearish. Currently trading around $487, MSFT is now testing that broken support level from underneath, which typically acts as resistance in bearish scenarios.

⬤ The technical picture shows back-to-back rejections in the $555 to $560 zone, completing the double top formation that sparked the selloff. Following the breakdown, the stock pushed down into the mid-$480s before staging a modest bounce. That bounce has brought price back up to test the underside of the former support, where it's now meeting resistance.

⬤ For traders watching short opportunities, this retest zone offers a potential entry if the stock continues rejecting the former support. On the flip side, bulls would need to see MSFT reclaim and hold above that broken range low to shift the structure back in their favor. Until that happens, the path of least resistance appears to be lower, with cautious sentiment dominating the technical setup.

⬤ The breakdown matters beyond just MSFT itself—as one of the heaviest-weighted stocks in major U.S. indices, continued weakness here could ripple through broader market sentiment. The failure to reclaim former support keeps technical pressure elevated and raises the question of whether this is just a healthy pullback or the start of something more sustained.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah