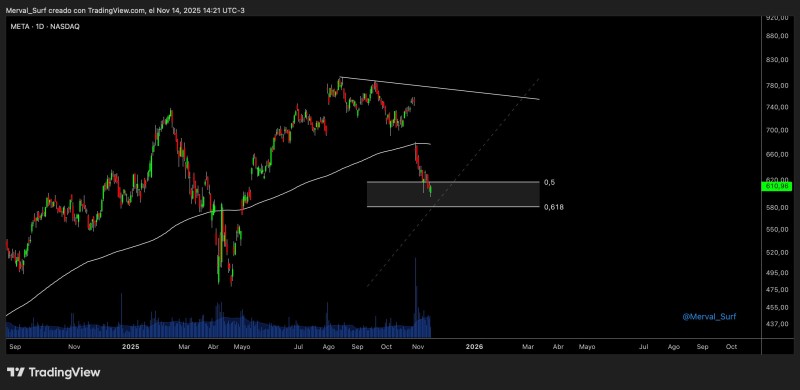

Meta Platforms (META) is testing a major support cluster after a sharp decline from recent highs. The stock has dropped into a key Fibonacci retracement area where traders look for potential turning points. The recent price action shows a clean rejection from the 200-day moving average, which triggered a corrective move into the 0.5–0.618 Fibonacci zone—a level where buyers often step in.

META Pulls Into a Fibonacci Support Cluster

The chart shows the 200-day moving average acting as resistance, preventing the stock from breaking higher. After briefly testing this level, META reversed and declined into the highlighted support box.

The lower boundary aligns with the 0.618 retracement, which typically marks a deeper corrective phase. Volume has picked up slightly during the decline, suggesting some accumulation may be starting as the stock reaches this important area.

Why META Is Testing This Level Now

Several factors appear to be driving the current pullback:

- Cooling momentum after a multi-month rally

- Broader sector rotation affecting large-cap tech stocks

- Macro uncertainty including rate expectations and shifting risk appetite

- Technical rejection at the 200-day moving average

These combined pressures pushed META into this deeper Fibonacci support area, where traders are watching for signs of stabilization.

Can META Reclaim the 200-Day Moving Average?

A sustained move back above the 200-day moving average would mark a significant bullish development. The long-term uptrend remains intact, meaning the broader trend hasn't been invalidated despite recent volatility. However, if META fails to hold the current Fibonacci zone, further downside could develop, especially if macro conditions weaken or selling pressure intensifies.

Trend Watch

Traders are focused on whether META can stabilize within the 0.5–0.618 support cluster. A successful base here would create room for a recovery into December and potentially set up another test of the 200-day moving average. As a key market bellwether, META's performance at this level may signal broader tech-sector sentiment heading into 2026.

Peter Smith

Peter Smith

Peter Smith

Peter Smith