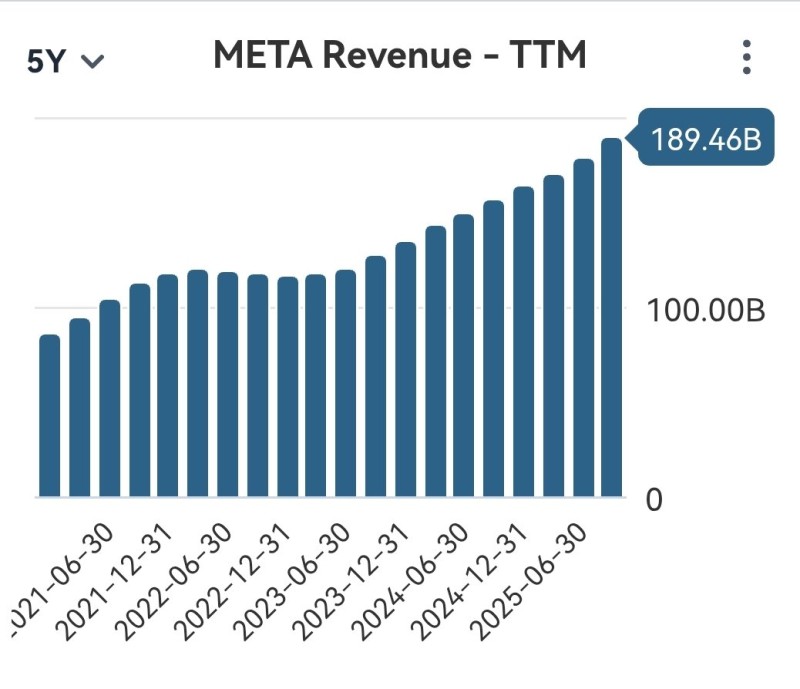

While markets tend to obsess over quarterly results, Meta Platforms keeps quietly building something bigger. The numbers tell a straightforward story: revenue just hit $189.46 billion for the trailing twelve months through mid-2025, the highest it's ever been. And yes, people are still worried about how much the company's spending. But if you zoom out even a little, the picture looks pretty solid.

The data shows Meta's been growing steadily for five years straight. Sure, there was a hiccup in late 2022 when advertisers pulled back across the board, but the company bounced back faster than most expected. That resilience says something about how well the ad business actually works and how scalable these platforms really are.

Why Heavy Spending Might Actually Make Sense

Here's the thing everyone's debating: Meta's pouring billions into AI infrastructure and data centers. Short-term thinkers hate it because it dents margins right now. But the company's clearly playing a longer game, betting that better recommendation engines, smarter ad targeting, and immersive tech will pay off down the road. It's the classic trade-off between immediate profits and building something that lasts.

History suggests the companies willing to make that bet often come out ahead, even if Wall Street complains for a few quarters. Meta's basically trying to evolve from "just" social media into a full AI-powered ecosystem. If they pull it off, the margins could expand significantly once everything scales up. And in the meantime, the stock's actually trading at a pretty reasonable multiple given the revenue growth. For anyone thinking long-term, that's not a bad setup.

What the Numbers Actually Show

Look at the five-year chart and you'll see steady upward movement, quarter after quarter. Meta's nearly doubled its revenue since mid-2021, which is impressive considering the economic headwinds everyone's been dealing with. Facebook, Instagram, WhatsApp — they're all still growing. Even Reality Labs, which burns cash, is part of the bigger infrastructure play. The consistency matters here. It's not about one lucky quarter. The company keeps executing through advertising slowdowns, privacy changes, and whatever else gets thrown at it. That kind of durability is rare.

What's Next

If the current pace holds and the AI investments start paying off, crossing $200 billion in annual revenue looks realistic within the next year or so. The fundamentals support it. Meta's not perfect, and the spending will keep making headlines, but the underlying business is as strong as it's ever been. For now, the company's doing what major tech players do: invest heavily, ignore the noise, and build for the next decade. Whether that pays off remains to be seen, but at nearly $190 billion in revenue and still growing, they've earned the benefit of the doubt.

Meta has reported record-breaking revenue of $189.46 billion for 2025, driven by strong ad performance, expanding AI infrastructure, and growth across its social platforms. The company’s continued investment in machine learning and personalized user experiences has reinforced its dominance in the digital ad space.

According to AI News, Meta’s new GEM model has boosted Instagram ad performance, enhancing targeting precision and user engagement.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov