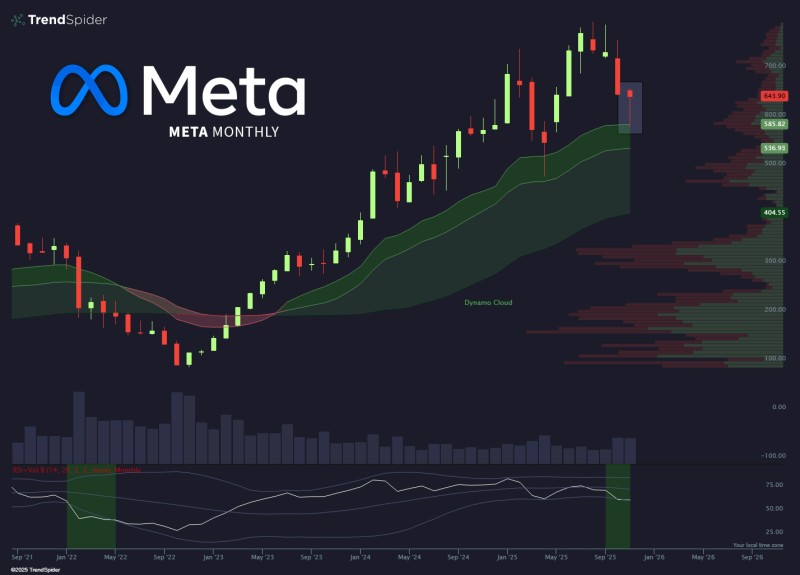

⬤ Meta Platforms showed a notable shift on the monthly chart after forming a strong reversal candle. The move comes during elevated trading activity and highlights renewed attention on the stock's long-term performance dynamics visible in the monthly setup.

⬤ Over the past 30 days, analyst sentiment strengthened significantly, with 20 firms issuing updated price targets. The average target now stands at $846, suggesting meaningful upside from recent levels. The highest estimate comes from Rosenblatt at $1,117, while the lowest is $720 from Cantor Fitzgerald. These revisions align with ongoing discussions about the stock's trajectory as META reacts within its multi-year structure.

⬤ The monthly reversal candle formed above key support zones while volume remained elevated, signaling heightened market engagement. The price action interacted with the Dynamo Cloud region, showing how META maintained broader trend strength despite recent fluctuations. The technical context reinforces the significance of this month's reaction and the timing of the updated analyst targets.

⬤ The combination of a prominent monthly candle and revised forecasts positions META as a focal point in large-cap tech discussions. The stock's behavior at current levels will influence sentiment around tech sector gains as AI-driven investment cycles and advertising demand shape expectations heading into the next market phase.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov