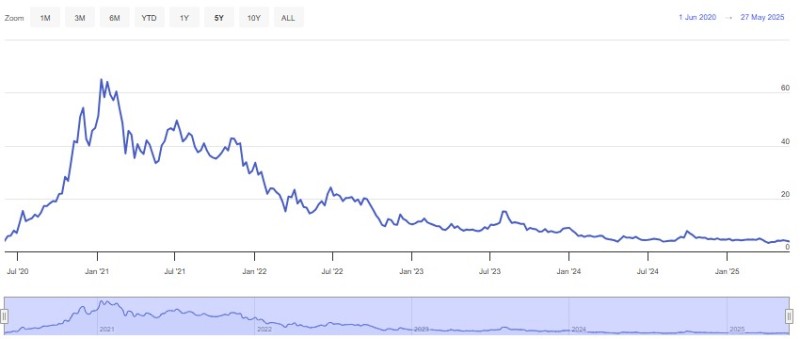

NIO (NYSE:NIO) shares have dropped 22% this year and now trade at $3.82, leaving investors wondering if this Chinese EV maker is finally cheap enough to buy.

NIO Inc. (NYSE:NIO) has been having a rough time lately. The Chinese electric vehicle company's stock sits at $3.82 right now - that's a brutal 22% drop over the past year. We're talking about a stock that was flying high above $7 back in October, and now it's scraping along near its yearly lows. So the big question everyone's asking is: has NIO finally gotten cheap enough to be worth your money?

Is NIO (NYSE:NIO) Actually Cheap Right Now?

Let's be honest - figuring out if a stock is truly undervalued isn't always straightforward, but we can look at some numbers that might give us clues. NIO's price-to-sales ratio is sitting at 0.88x, which sounds pretty good when you compare it to the industry average of 1.33x. Basically, you're paying less for each dollar of sales compared to other EV companies.

But here's where things get tricky. We can't even calculate NIO's price-to-earnings ratio because the company is still losing money. And let's face it - buying a stock that's consistently bleeding cash isn't exactly what most investors would call a "safe bet." It's one of those red flags that makes you think twice.

When we look at enterprise value (which is basically another way to figure out what a company is worth), it lines up pretty closely with NIO's market cap. That tells us the market isn't really mispricing the stock in any obvious way. So based on these traditional metrics alone, it's hard to say definitively whether NIO is a bargain or not.

What's Coming Next for NIO's Business?

Sometimes a stock looks cheap because investors aren't seeing the bigger picture of what's ahead. NIO has some interesting things in the pipeline that could shake things up. They're getting ready to launch the Onvo L90 later this year - it's a long-range EV that's aimed at regular folks, not just the luxury crowd. Early buzz around this car has been pretty positive, which is encouraging.

They're also working on another brand called Firefly that's all about affordable electric cars for city dwellers. The plan is to roll this out across 16 different markets this year. If you think about it, that's a pretty ambitious expansion that could really boost their sales numbers if they pull it off right.

The whole sub-brand strategy makes sense when you think about it. Tesla did something similar by eventually offering cheaper models alongside their premium cars. If NIO can capture both the high-end market with their main brand and the mass market with these new sub-brands, they could significantly grow their customer base.

NIO's Big Plans Beyond China

One thing that's got people talking is how NIO is trying to expand outside of China. Europe is obviously a huge market, and even though EV sales there have been a bit sluggish lately, there's still massive potential. European customers are generally willing to pay more for premium features, which could help NIO's profit margins.

They're also making moves in the UAE, which is interesting because that market has money to spend and is pretty focused on going green. NIO's battery-swapping technology could be a real game-changer in places where people are worried about charging infrastructure.

Here's the thing though - expanding internationally is expensive and risky. You're dealing with different regulations, consumer preferences, and competition in each market. NIO's success outside China isn't guaranteed, but if they can make it work, it could be huge for their long-term growth.

The Reality Check: It's Getting Tough Out There

Let's not sugarcoat this - the EV market is brutal right now. Tesla is still the big dog, and traditional car companies like Ford and GM are throwing serious money at their own electric vehicles. Then you've got Chinese competitors like BYD that are also fighting for the same customers NIO wants.

The European slowdown in EV demand is particularly concerning because that was supposed to be one of NIO's key growth markets. When governments started pulling back on EV incentives, sales dropped off pretty quickly. That's not just a NIO problem - it's hitting the whole industry.

Competition in China is also heating up. BYD, Xpeng, Li Auto - they're all hungry and they all want a bigger piece of the pie. NIO needs to keep innovating and find ways to stand out, which costs money they're already spending on expansion and new products.

So, Should You Buy NIO Stock Under $4?

Look, NIO probably is undervalued at these levels. The company has solid technology, interesting products coming out, and they're expanding into new markets. But calling it an "unmissable bargain" might be pushing it a bit.

The EV industry is going through some growing pains right now. Demand has cooled off in some key markets, competition is fierce, and companies are struggling to become profitable. That's a challenging environment for any EV stock, not just NIO.

If you're thinking about buying NIO, you need to be comfortable with volatility and uncertainty. This could be a great long-term play if they execute well, but it's not going to be a smooth ride. The stock could easily drop more before it recovers, and there's no guarantee it will recover quickly.

The bottom line? NIO might be cheap, but "cheap" doesn't always mean "good investment." You'd probably want to see some clearer signs that the EV market is stabilizing and that NIO is making real progress toward profitability before jumping in with both feet. Sometimes it's better to pay a fair price for a growing business than to buy a potentially undervalued stock in a sector that's facing headwinds.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah