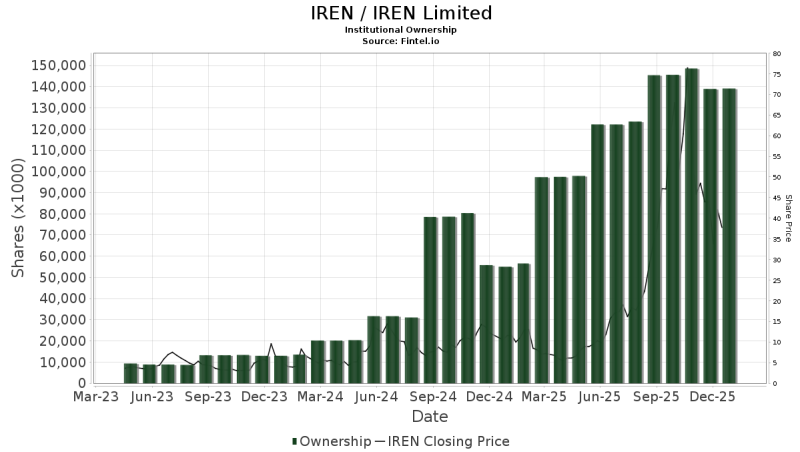

⬤ IREN shares dropped about 16 percent over the past month, but here's the thing - institutional ownership is still sitting at historically high levels. The latest data shows a massive gap between long and short positions, with big institutions holding onto their shares even as the price pulls back. The ownership chart shows institutions steadily adding shares throughout 2024 and into 2025, completely unfazed by recent volatility.

⬤ Institutional holders now control more than 140 million IREN shares - a huge jump from where things stood in early 2024. The accumulation happened in waves, with major buying sprees visible in mid 2024 and continuing through 2025. Meanwhile, IREN's stock price shot up before cooling off late in the year, but institutions kept buying even as the momentum faded.

⬤ The positioning breakdown tells an interesting story: roughly 374 long positions versus just 13 shorts. That lopsided setup matches what we're seeing in the ownership data - institutions haven't reduced their holdings during this recent pullback. So while the stock price has been bouncing around, the big players aren't heading for the exits. This price weakness is happening without any real selling pressure from the major holders.

⬤ This split between falling prices and steady institutional ownership matters for anyone watching IREN. When stocks decline but institutions stick around, you're usually looking at a consolidation phase rather than everyone bailing out. This dynamic affects sentiment across similar sectors, especially in capital intensive tech and infrastructure plays where institutional money drives the action. Bottom line: tracking who owns what matters just as much as watching the price, because when major holders stay put, it shapes how liquid and volatile the stock can get going forward.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah