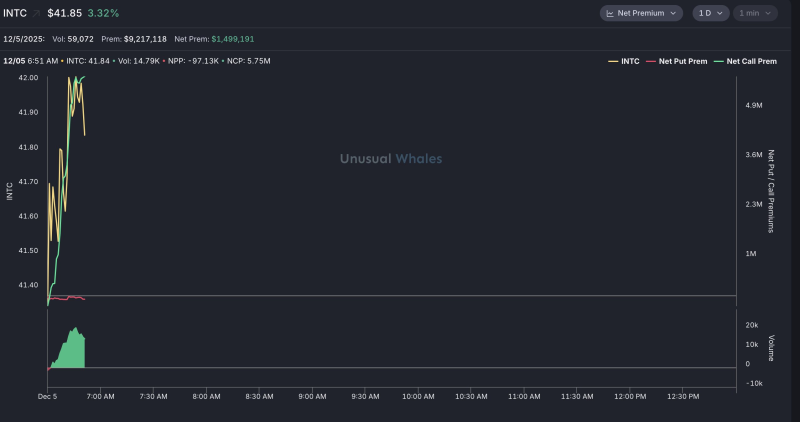

⬤ Intel shares rose more than 2 % at the start of the session after a sharp jump in options turnover. The price reached $41.85 soon after the opening bell reflecting steady buying pressure from the first minute.

⬤ Options numbers showed a clear bullish bias - net call premium came in at about $5.75 million, while put premium registered minus $97 000. The price move echoed that mood - INTC leapt from $41.30 and cleared $41.90 within minutes of the open.

The heavy call demand paired with instant price strength highlights rising focus on Intel's short term path.

⬤ Total options premium exceeded $9.2 million placing Intel among the busiest names that morning. The stock stayed close to its peak after the early spurt and the link between a higher share price plus swelling call premium indicated fresh hunger for upside positions.

⬤ Sudden swings in options premiums often flag shifts in short term momentum, particularly for a large chip name like Intel. The robust call activity and prompt price advance show traders are watching closely to see where INTC goes next.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi