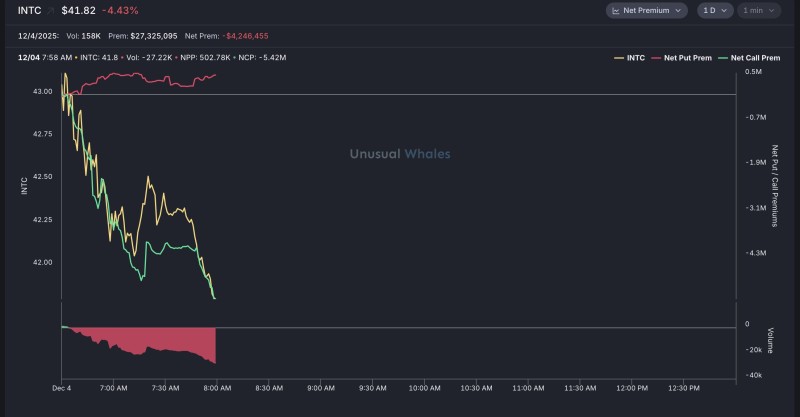

⬤ Intel took a beating during early Monday trading, dropping over 4% to around $41.82. The stock started the day above $43 but couldn't hold those levels, sliding steadily lower as the morning progressed. The selloff gained momentum right after the opening bell and didn't let up throughout the first hour.

⬤ The options market tells an even more interesting story. Intel saw about $27.3 million in premium volume with 158,000 shares changing hands early on. What really stands out is the net premium sitting at negative $4.24 million—a clear sign traders were betting on further downside. Put activity dominated the session while calls got crushed at negative $5.42 million. As one analyst noted, "The relationship between falling price momentum and bearish premium flow provides insight into how market participants reacted during the morning downturn."

⬤ Looking at the flow patterns, negative net premium kept expanding as INTC broke through $42.50 and then $42. The put-side pressure just wouldn't quit, with traders piling into downside protection as the stock kept sliding. This kind of coordinated movement between price action and options positioning doesn't happen by accident.

⬤ When you see negative net premium spikes like this, it usually means the market's getting nervous about what's coming next. Intel's 4% drop paired with heavy put activity shows a major shift in how traders are viewing the stock. The gap between call and put positioning widened throughout the session, painting a pretty clear picture of where sentiment stands right now.

Usman Salis

Usman Salis

Usman Salis

Usman Salis