Hims & Hers Health has been one of the more polarizing names in the health and wellness space. Bulls point to strong user growth and expanding product lines. Bears flag insider activity and price swings as warning signs. But if you look past the noise and zoom out on the ownership data, a clearer pattern starts to emerge — one that cuts against the narrative that smart money is quietly walking away from HIMS.

Big Money Has Been Buying, Not Running

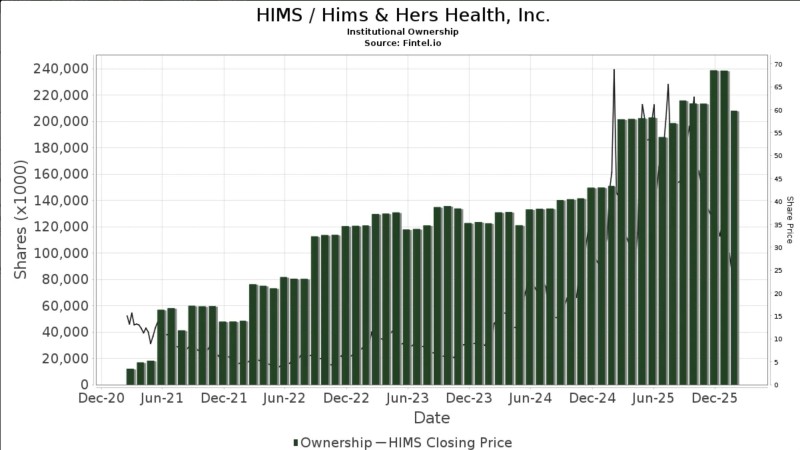

When a stock gets volatile, the first question traders ask is: are institutions bailing? With Hims & Hers Health (HIMS), the data gives a pretty clear answer — and it might surprise those expecting a selloff story. Despite sharp price swings over the past few years, big institutional holders have actually been building positions, not unwinding them.

According to Fintel.io data, institutional share holdings climbed from under 20 million shares in 2021 to over 200 million by late 2025 — a more than 10x increase. The trend held firm through multiple rounds of volatility, with ownership levels rising consistently across 2021, 2022, 2023, and into 2024-2025. Large investors were adding exposure even during the stock's rougher patches, not trimming it.

Insider Selling Adds Complexity to the Picture

That said, the ownership story isn't entirely one-directional. Insiders have reportedly sold close to $190 million in shares as ownership dynamics shifted in late 2025, which has drawn attention from traders watching for signals of fading confidence. Some institutional holders also trimmed positions during this period, pointing to possible tactical rebalancing rather than outright conviction in one direction.

This gap between long-term accumulation and short-term trimming is the crux of what makes HIMS positioning interesting right now. Sustained high institutional ownership can act as a stabilizing floor during price drops. But when insiders start reducing exposure, it tends to invite scrutiny — especially in a volatile growth stock.

HIMS has already shown it can bounce, reclaiming 14% from lows near a key Fibonacci support level — a move that suggests buyers are still stepping in at technical levels. As Hims & Hers continues to evolve its business, tracking how institutional holders respond to earnings and macro shifts will be one of the clearest ways to gauge where real conviction sits.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov