⬤ Hims & Hers Health Inc. took a hit lately—shares are down about 18% over the past month. But here's the interesting part: institutional investors aren't selling. Big holders actually kept their positions intact through the decline, which means we're not seeing major distribution happening behind the scenes.

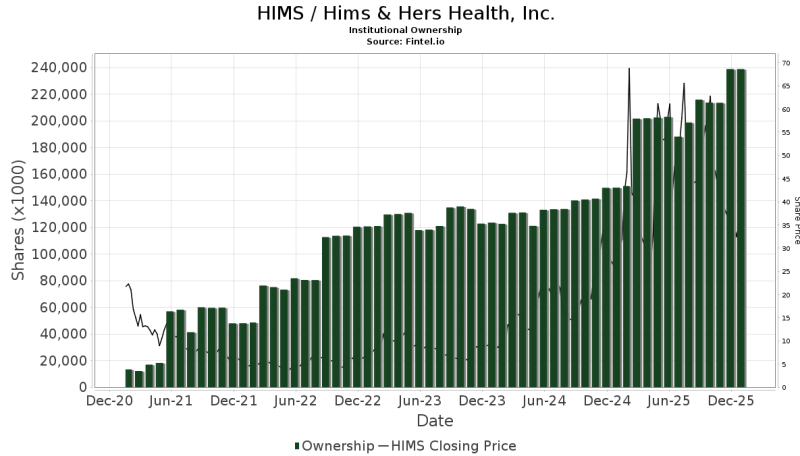

⬤ The data tells a pretty clear story. Institutional ownership has been climbing steadily since 2021, now sitting at over 240 million shares. That growth hasn't stopped, even when the stock got choppy or pulled back. Through volatility spikes and price corrections, institutions kept accumulating. Even during this recent weakness, those share counts stayed elevated—no panic selling from the big players.

⬤ The positioning numbers back this up. There are 861 long positions on record versus just 26 short positions. That's a massive imbalance. So this recent drop? It doesn't look like it came from institutional selling or a wave of new shorts piling in. More likely, it's just short-term market pressure playing out while the bigger holders sit tight.

⬤ This disconnect matters. When a stock falls but institutions don't bail, it usually signals a temporary reset rather than a real breakdown in confidence. For HIMS, the key now is watching how price action develops against these ownership trends—that relationship often sets up the next move.

Usman Salis

Usman Salis

Usman Salis

Usman Salis