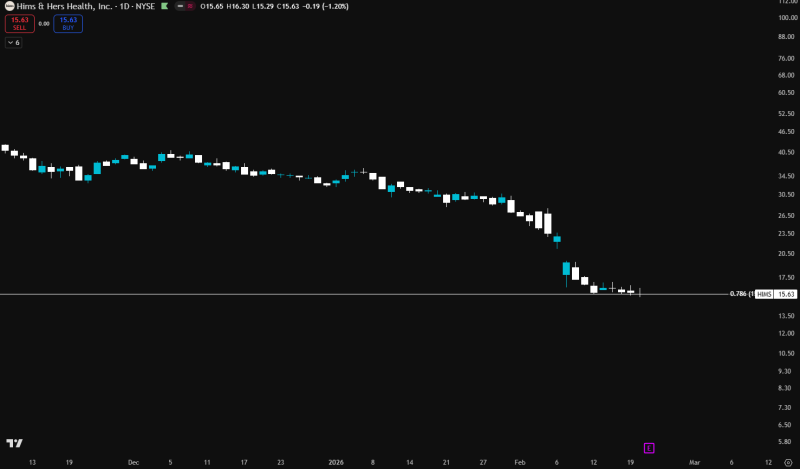

Shares of Hims & Hers Health (NYSE: HIMS) are trading around $15.63, holding onto a key support level that technical traders have been watching closely. The stock has been locked in a tight range between $15.50 and $16 for several weeks now, and this prolonged defense of the 0.786 Fibonacci retracement is generating real discussion about whether HIMS is finally putting in a bottom.

Key Fibonacci Level Acts as the Last Line of Defense

Looking at the daily chart, the story is pretty straightforward: HIMS fell hard from its earlier highs and is now sitting at a critical support zone near $15.75 after a five-month decline. The compressed candlesticks clustering near this level suggest buyers are showing up, even if conviction remains low.

What makes this level interesting is that HIMS hasn't decisively broken below the retracement band despite repeated tests. In technical analysis, when a stock defends a Fibonacci level long enough, it can signal that sellers are running out of steam. That said, the broader trend is still bearish — momentum indicators signaled continued downside pressure below key levels, which limits any short-term optimism.

Breakdown Below $15 Would Open the Door to $13.50

The next few weeks will likely be decisive. If HIMS holds this zone, traders may start pricing in a consolidation phase or a potential bounce. But a clean break below the 0.786 level would shift the picture considerably. Previous analysis flagged the next historical support area near $13.50 as the downtrend deepens if current levels fail, which would mark a significant additional decline from where the stock sits today.

For now, HIMS is in a wait-and-see mode. The Fibonacci floor is holding, but so is the bearish pressure. Chart-based traders will be watching price action closely around this zone for any sign of a breakout or breakdown that sets the direction for the next leg.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah