The Bill & Melinda Gates Foundation Trust just executed a major portfolio shift. Despite its deep historical connection to Microsoft through Bill Gates, the Trust slashed its MSFT stake by 65% this quarter. The move, revealed in the latest 13F filing, is turning heads across Wall Street.

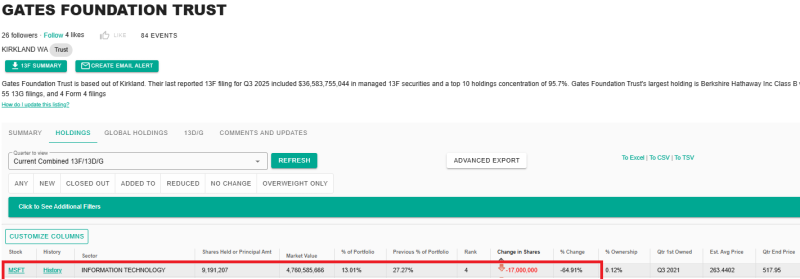

The numbers tell the story: Microsoft shares in the portfolio fell from more than 26 million down to 9,191,207. That's a 17 million share dump — a 64.91% cut. The stock's weight in the portfolio dropped from over 27% down to just 13.01%.

It's one of the most dramatic single-quarter reductions the Trust has made to its Microsoft position.

Breaking Down the Sale

- Shares sold: 17,000,000

- Remaining shares: 9,191,207

- Current market value: $4.76 billion

- MSFT price at quarter-end: $517.95

- Estimated average sale price: $263.44

- Portfolio weight: dropped from 27.27% to 13.01%

- New position ranking: #4 in portfolio

- Ownership stake: 0.12% of Microsoft

The Trust first loaded up on these shares in Q3 2021. Microsoft's price has more than doubled since then, making this look like a straightforward profit capture rather than bearish sentiment.

Possible Reasons Behind the Move

Several factors could explain the timing and size of this sale:

- Locking In Gains After Strong Performance: Microsoft's been on fire throughout the AI revolution. Selling after a stock doubles — especially at record highs above $500 — is textbook portfolio management.

- Converting Assets for Charitable Programs: Foundations routinely liquidate appreciated holdings to bankroll their missions. Turning paper gains into actual capital for global programs is standard practice for organizations this size.

- Strategic Portfolio Adjustment: The Trust frequently reallocates capital among its biggest positions like Berkshire Hathaway and Waste Management. This Microsoft trim follows that approach, though the scale is notably bigger than usual.

What Investors Should Make of This

When an institution unloads $8.8 billion worth of stock, people notice. But this doesn't necessarily signal problems with Microsoft's business. The company continues to lead in AI development, cloud computing, and enterprise solutions.

The real takeaway here is about position sizing. Even with top-tier companies, concentration carries risk. The Trust's decision looks methodical and disciplined — more about smart asset management than any red flags about Microsoft's future.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah