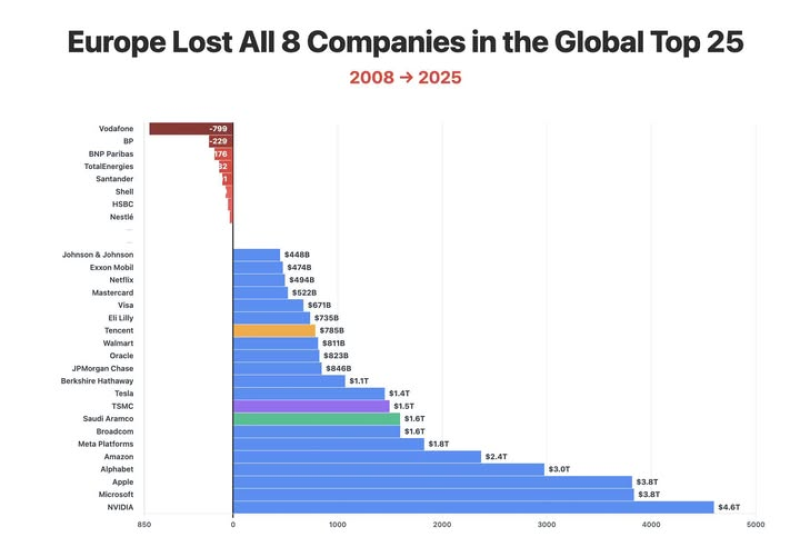

By 2025, something remarkable happened: not a single European company remains in the world's top 25 by market capitalization. This marks a dramatic reversal from 2008, when eight European giants held spots in this exclusive club.

The numbers tell a clear story. American companies now hold 18 of the top 25 spots (72%), China claims 4 (16%), Taiwan has 2 (8%), and Saudi Arabia rounds out the list with 1 (4%). Europe? Zero.

The Staggering Scale

To understand how wide this gap has grown, consider that Apple ($3.83T) and Microsoft ($3.85T) are each worth more than Europe's 10 largest companies combined. NVIDIA, riding the AI wave to a $4.6T valuation, operates in a league that Europe simply doesn't compete in anymore.

What Happened to Europe's Champions

In 2008, Europe's corporate elite included household names:

- Shell (#3)

- BP (#8)

- HSBC (#7)

- Santander (#22)

- BNP Paribas (#24)

- Nestlé (#25)

- TotalEnergies (#18)

- Vodafone (#19)

Their decline has been brutal. Shell dropped from 3rd to 73rd place. BP tumbled from 8th to 237th. Vodafone crashed from 19th to 818th. Even the most resilient, like HSBC (now 55th) and Nestlé (56th), are nowhere near their former standing.

The reasons aren't mysterious. Europe bet heavily on traditional industries—banking, oil, telecoms—while the world pivoted to tech. Digital transformation came slower. Investment in AI and cutting-edge technology lagged. And unlike the unified American market or China's coordinated approach, Europe's regulatory patchwork made it harder for champions to emerge and scale quickly.

Today's European leaders tell the story: ASML at $400B (ranked 27th globally), followed by luxury conglomerate LVMH, software firm SAP, and pharmaceutical company Novo Nordisk. They're solid businesses, but they're not competing with trillion-dollar tech titans.

Looking Ahead

Analysis based on 2025 market data. Original research compiled by financial analyst Maria Kowalski.

This shift represents more than numbers on a spreadsheet—it's a fundamental realignment of economic power. While America and Asia build the next generation of technology leaders, Europe finds itself watching from the margins of global capital markets, still searching for the formula that will bring its companies back to the world stage.

Usman Salis

Usman Salis

Usman Salis

Usman Salis