The commercial real estate world is shifting beneath our feet. Data center construction spending is about to eclipse traditional office investments—a milestone that's never happened before. AI, cloud computing, and our increasingly digital economy are redirecting billions away from office towers and into the infrastructure that powers our online lives.

Key Trends

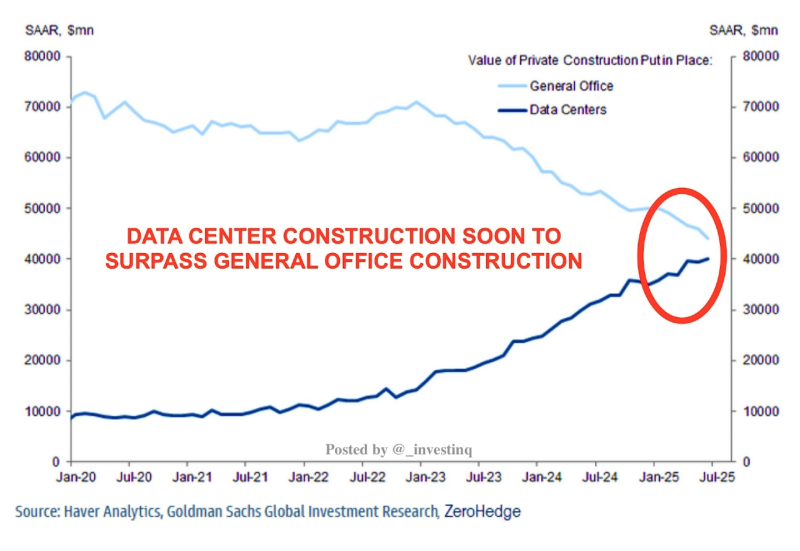

According to Stock Sharks and Haver Analytics data, office construction peaked above $70 billion during 2020–2022 but has dropped below $50 billion by mid-2025. Meanwhile, data center construction exploded from under $10 billion in early 2020 to over $40 billion in 2025. The two lines are set to cross in early 2025, marking a fundamental shift in where money is flowing. This isn't just a blip—it reflects a deeper change in how we think about growth and infrastructure.

What's Driving This Shift

The AI boom needs serious computing muscle. Training cutting-edge models requires enormous data centers that consume massive amounts of energy. At the same time, remote and hybrid work patterns have crushed demand for new office space, leaving city centers with excess capacity. Investors are taking notice, rotating capital from struggling office REITs into digital infrastructure where the outlook looks far brighter. Government policy is helping too, with tax credits and grid upgrades increasingly favoring data infrastructure over traditional commercial real estate.

Who Wins and Who Loses

The winners are clear: cloud giants like Amazon, Microsoft, and Google; chip makers like Nvidia and AMD; and data center REITs such as Equinix and Digital Realty. On the flip side, office landlords and traditional commercial REITs face declining valuations and weak tenant demand. There's also an energy angle—data centers are power-hungry, and electricity demand is expected to spike, creating new opportunities in energy markets.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah