A sudden surge in BYD's financial liabilities is catching the attention of analysts and investors, as fresh company filings reveal debt growth far beyond what the automaker has historically carried. The new data suggests that BYD's aggressive scaling strategy may be pushing up against the limits of its balance sheet.

BYD's Aggressive Expansion Strategy Sparks Debt Concerns

Recent analysis by trader AJ highlighted a sharp rise in leverage and capital inflows, and the numbers back up the severity of this shift.

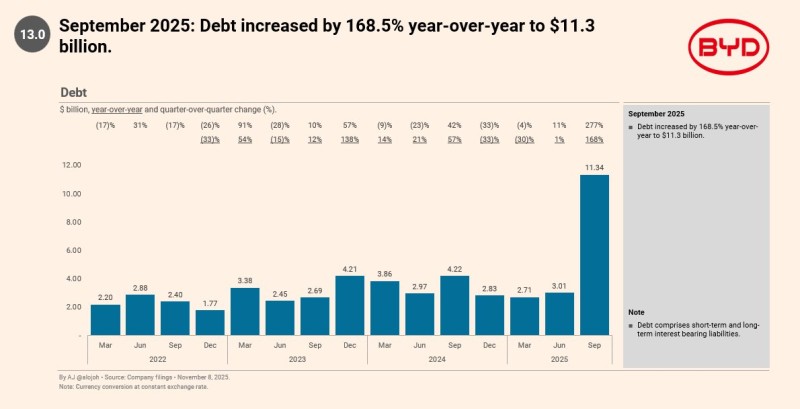

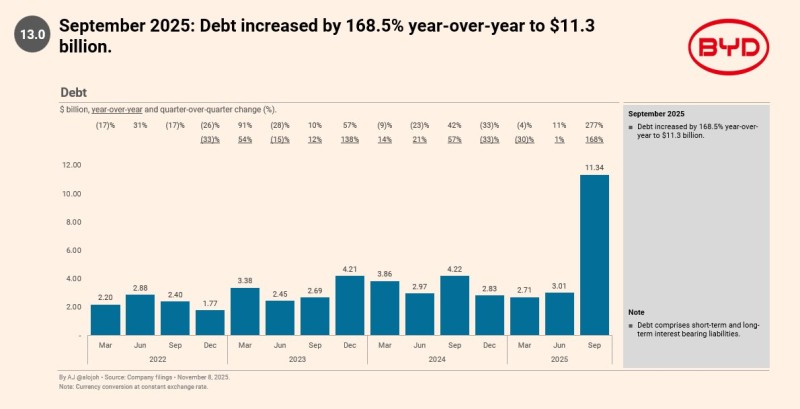

September 2025 data shows a massive 168.5% year-over-year increase in total debt, hitting $11.34 billion—easily the highest level recorded in years.

This isn't just a quarterly blip. Looking at the long-term debt chart, BYD consistently operated within a $2–4 billion range from 2022 through mid-2025, with occasional fluctuations but nothing close to what we're seeing now.

The September 2025 figure stands dramatically apart, jumping to nearly three times the previous peak of $4.21 billion recorded in late 2023.

This represents a phase of unprecedented debt accumulation, not a routine cyclical increase.

Drivers Behind BYD's Debt Acceleration

Record capital raising: Filings confirm an all-time-high net financing cash flow of $7.2 billion, showing heavy reliance on external capital to fund expansion, battery development, and global manufacturing operations.

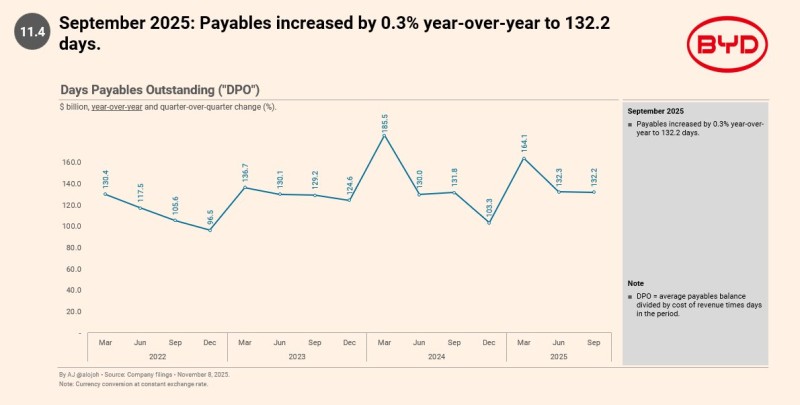

Elevated supplier credit pressure: The Days Payables Outstanding chart shows 132.2 days in September 2025, slightly higher year-over-year. This means BYD now takes over four months to pay suppliers, signaling a strategy of liquidity preservation, dependence on supplier credit, and potential operational cash-flow strain.

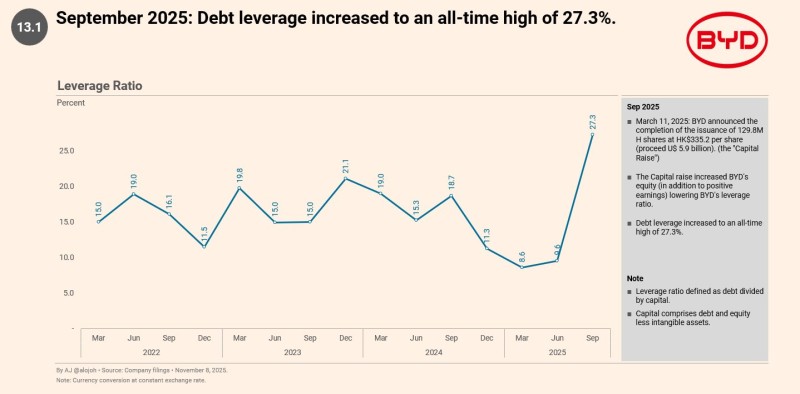

Leverage reaches a record high of 27.3%: The leverage ratio chart highlights a steep climb throughout 2025, with September marking the highest metric in the entire dataset. Even after BYD's March 2025 capital raise of 129.8 million H-shares, leverage still increased, showing that liabilities expanded faster than equity could catch up.

A Broader Look at BYD's Financial Position

The pattern is consistent across all metrics: debt has grown at a rate completely disconnected from historical norms, supplier payment cycles remain extremely extended, and leverage has surged to unprecedented levels. The September 2025 spike clearly represents a structural shift, not a temporary fluctuation. Meanwhile, BYD's share price of HKD 97.9 implies a robust $120.8 billion market cap, yet the valuation may not fully reflect these rising financial risks.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir