⬤ AST SpaceMobile Inc. is catching serious attention after fresh dark pool data revealed massive off-exchange trading near current price levels. With ASTS hovering around $97—just shy of its all-time high of $102.79—the data strongly suggests institutional accumulation is underway.

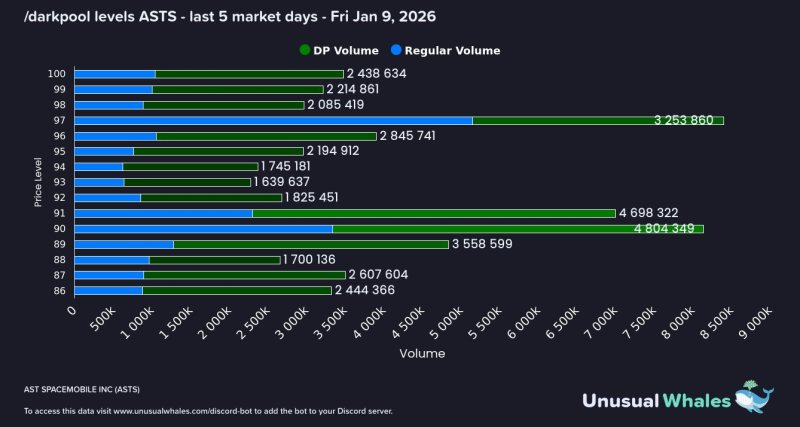

⬤ The numbers tell the story. Over the last five trading days, dark pool volume between $86 and $100 hit roughly 40.1 million shares, accounting for about 17% of the entire float. The heaviest action happened between $89 and $91, where individual price points saw around 4.8 million, 4.7 million, and 3.6 million shares changing hands off public exchanges. This concentrated activity just below current prices points to sustained institutional interest.

⬤ Here's what makes this significant: ASTS is trading at the upper edge of this accumulation zone, and dark pool volume actually exceeded regular market volume at several price levels. Large block trades executed in dark pools typically aim to minimize market impact, and when this volume clusters near higher prices rather than being spread out, it usually signals accumulation, not distribution.

⬤ With ASTS sitting near record levels alongside heavy off-exchange participation, the interplay between visible market trading and dark pool activity could drive near-term price movement and volatility around key resistance zones.

Peter Smith

Peter Smith

Peter Smith

Peter Smith