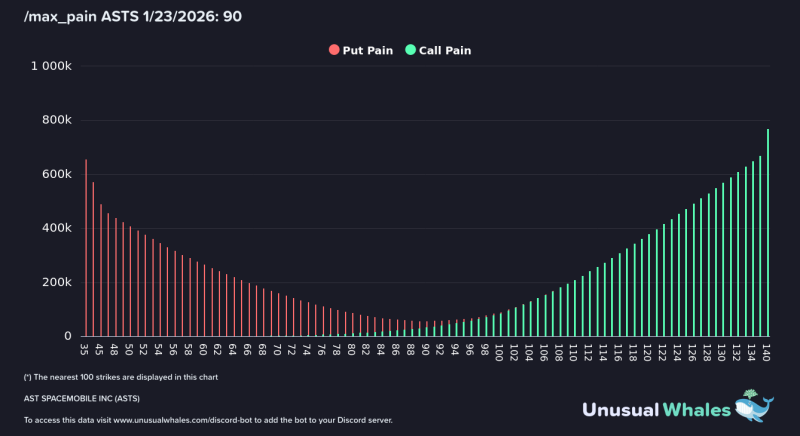

⬤ AST SpaceMobile (ASTS) is heading into the January 23 expiration with shares at $116—comfortably above the $90 max pain level where options holders would feel the most pressure. The current options board shows a lopsided structure: calls are loaded up high while puts cluster way down low. This spread tells traders one thing: the market's betting on strength, not weakness.

⬤ Put contracts are mostly parked between $30 and $70, acting as insurance policies against a major collapse rather than bets on an imminent drop. As strikes climb toward the current price, put interest fades quickly. There's barely any downside positioning near spot price, which means few traders are bracing for a sudden reversal before Friday's close.

⬤ The call side tells a different story. Starting around $96, call positioning ramps up hard, with the heaviest concentration between $120 and $140. The volume more than doubles as you move through this zone, showing aggressive bullish exposure.

The options structure points to strong bullish momentum while downside puts remain concentrated far below spot price, according to the analysis.

This setup creates potential for dealer hedging to push prices higher—if traders keep buying calls, market makers may need to buy the underlying stock to stay balanced, adding fuel to any rally. With price already $26 above max pain, there's clear runway toward $120-$130 if momentum holds, though some traders might start taking profits as expiration nears.

⬤ When spot price sits this far above max pain and calls dominate the higher strikes, volatility often picks up into expiration. The downside protection exists, but it's distant. What matters now is the call wall stacked above current prices—it shows conviction that ASTS has room to run, at least through this weekly expiration cycle.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah