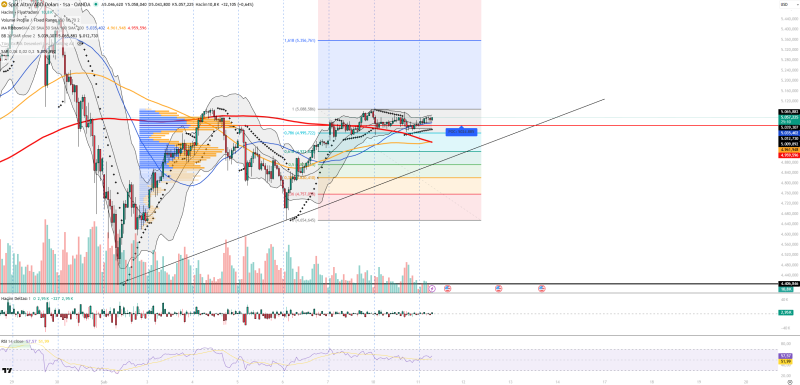

⬤ Gold in the XAU pair continues holding above its rising trend line after a short-term recovery, but price movement has slowed inside a strong resistance zone. Candles remain small and indecisive, showing limited upside attempts rather than any real breakout energy.

⬤ Technical indicators paint a cautious picture right now. RSI sits near 57, keeping a neutral-to-positive bias but without strong momentum behind it. Trading volume stays low and doesn't support any expansion moves. The Volume Profile puts the equilibrium level around 5024, and price keeps bouncing around this balance zone. Bollinger Bands are compressing between the middle and upper bands, while Parabolic SAR remains below price, confirming the short-term upward structure is still intact. This matches up with gold consolidating below resistance and broader gold consolidates after rally behavior we've been seeing.

⬤ Support levels sit at 5024, 4991, 4959 and 4654, while resistance stands at 5057, 5085, 5210 and 5356. Volume delta stays positive but pretty limited, meaning buyers are around but they're not dominating the action. This sideways behavior near resistance often shows hesitation, similar to gold stuck at resistance during a correction.

⬤ U.S. macroeconomic data and dollar index movements remain the main drivers for gold right now. Continued dollar weakness might support some upside testing, while stronger risk appetite could put a cap on gains. The current structure really reflects macro-driven uncertainty rather than any confirmed directional move in XAU.

Peter Smith

Peter Smith

Peter Smith

Peter Smith