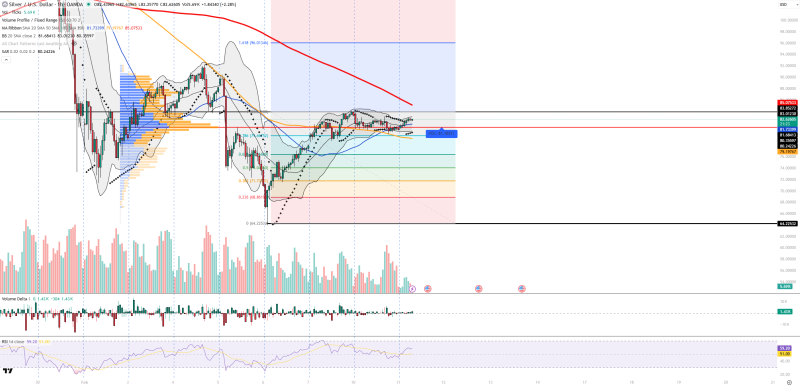

After bouncing from its recent bottom, silver entered a consolidation phase just below a critical resistance area. The precious metal now trades in a tight range around the $81 balance zone, showing indecision as traders wait for clearer directional signals and confirmation from macro drivers.

Silver Tests $83 Resistance After Recent Recovery

Silver in the XAG pair rebounded from the recent bottom and formed a short-term rising structure, but the rally lost steam at a strong resistance area. Small candles and lack of expansion indicate indecision rather than a confirmed breakout, signaling that buyers haven't taken full control yet. The precious metal struggled to break through overhead levels even as it maintained gains above the $81 pivot zone.

The technical picture shows mixed signals that suggest traders are taking a wait-and-see approach. RSI hovers near 59, staying positive but lacking the strength needed for a sustained push higher. Volume remains low and doesn't support upward continuation, which typically means institutional players aren't fully committed to either direction yet. The Volume Profile places the equilibrium level around $81.18, and price keeps fluctuating around this balance zone without establishing a clear direction. This neutral positioning reflects uncertainty about the next major move.

Bollinger Bands show the market stuck in this intermediate zone, similar to consolidation phases described during support zone reactions in silver markets and periods of technical inflection after moving average breakdowns.

Key Levels and Market Structure Point to Sideways Action

Key supports are located at $81.18, $80.35, $79.20 and $68.86, while resistance levels stand at $83.12, $85.07, $86.01 and $90.00. Neutral volume delta confirms no clear buyer dominance and reinforces the sideways structure. This setup resembles situations where price holds below major breakout zones, such as long-term bull structure below key resistance. Breaking above $83.12 would open the door to the upper resistance cluster, while losing $81.18 could trigger a retest of lower support levels.

Dollar index direction and U.S. interest rate expectations remain the primary macro drivers for silver right now. A weaker dollar may allow further upside tests, while increased risk appetite could create downward pressure. The current structure reflects a market waiting for confirmation rather than establishing a directional move, with traders on the sidelines until clearer signals emerge from both technical patterns and fundamental developments. Until then, expect choppy price action within the established range as neither bulls nor bears gain the upper hand.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah