Amazon (AMZN) delivered another impressive quarter, demonstrating how far it's come from its roots as an online retailer. The company has evolved into a diversified technology powerhouse where cloud computing and digital advertising now fuel most of its profit growth, even as its traditional retail operations continue expanding steadily.

Revenue Breakdown

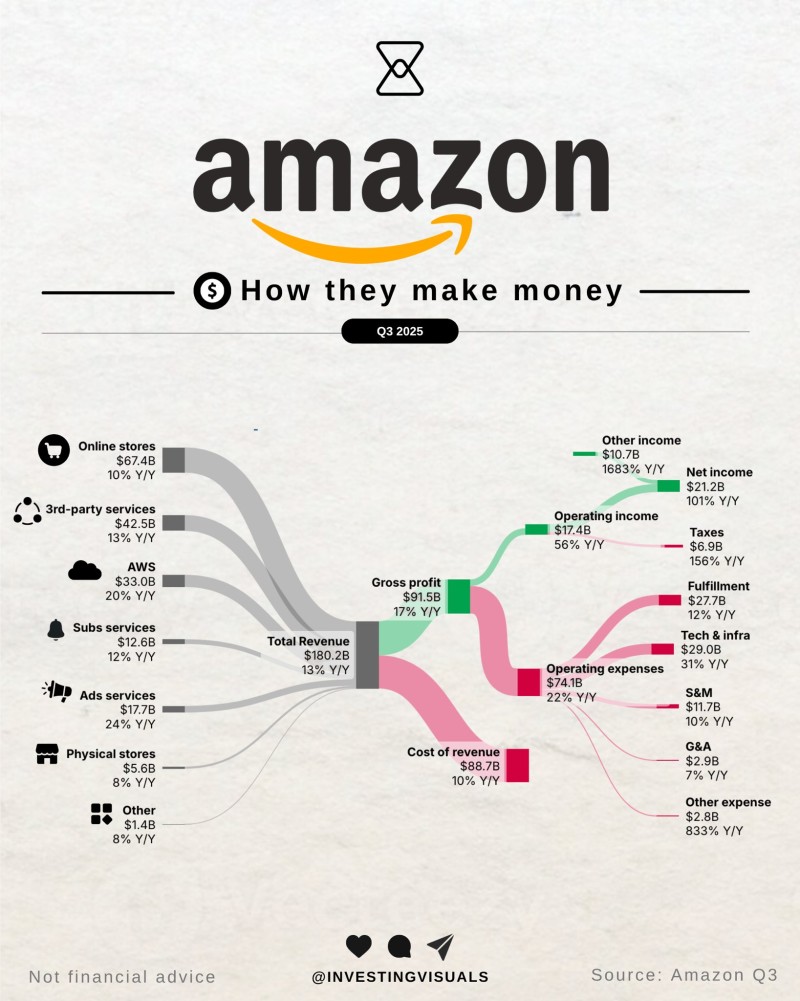

According to Investing Visuals, Amazon generated $180.2 billion in total revenue during Q3 2025, representing 13% growth compared to the same period last year. The online store business contributed $67.4 billion with 10% year-over-year growth, but the company's high-margin segments showed even stronger performance.

Third-party seller services reached $42.5 billion (up 13%), while AWS cloud services hit $33 billion (up 20%). Advertising revenue climbed to $17.7 billion with 24% growth, subscription services including Prime brought in $12.6 billion (up 12%), and physical stores added $5.6 billion (up 8%). Overall gross profit reached $91.5 billion, up 17% year-over-year, reflecting improved efficiency and stronger margins across business units.

Profit Surge

The company's profitability metrics showed remarkable improvement. Operating income jumped 56% to $17.4 billion, while net income doubled to $21.2 billion, marking a 101% increase and delivering the best results in years. Operating expenses increased 22% to $74.1 billion due to investments in technology infrastructure and logistics networks, yet profit margins still expanded significantly, showing that revenue growth is outpacing cost increases.

AWS and Ads Lead the Way

Although AWS represents just 18% of total revenue, it remains Amazon's most profitable division, cementing the company's position in cloud computing and AI development. The advertising business has grown rapidly, climbing 24% and establishing Amazon as a serious competitor in the digital advertising market alongside Google and Meta.

Peter Smith

Peter Smith

Peter Smith

Peter Smith