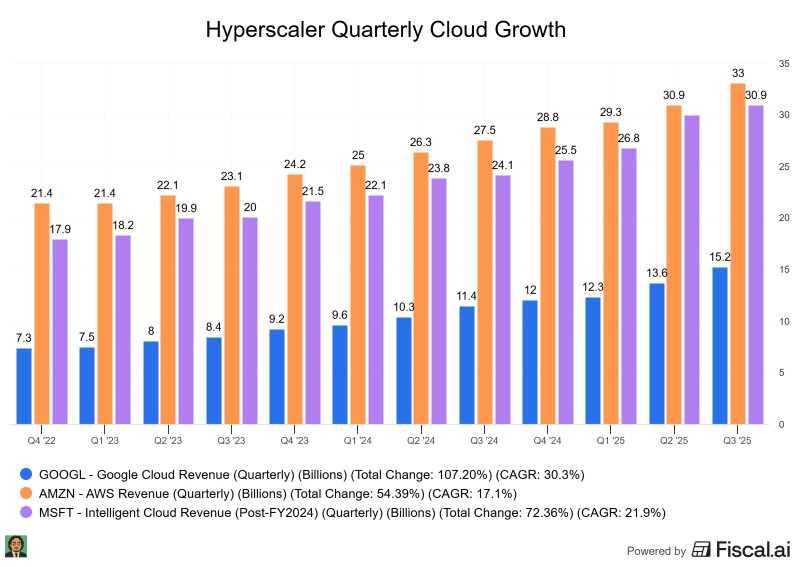

The cloud wars are heating up. Fresh Q3 2025 figures show Amazon, Microsoft, and Google still dominating enterprise infrastructure, but their growth paths are diverging sharply. Amazon added the most revenue while Google grew fastest, leaving Microsoft's momentum trailing.

Three Giants, Three Different Stories

According to CPA trader Mindset for Money, the Hyperscaler Quarterly Cloud Growth chart shows where each provider stands after three years of competition.

The numbers tell a story of diverging fortunes:

- Amazon Web Services climbed from $21.4 billion in Q4 2022 to $33 billion in Q3 2025, a 54% increase. AWS added $2.1 billion this quarter, the largest absolute gain.

- Google Cloud doubled from $7.3 billion to $15.2 billion, a 107% surge. It added $1.5 billion this quarter, an 11% quarter-over-quarter jump that outpaces both rivals.

- Microsoft Intelligent Cloud grew from $17.9 billion to $30.9 billion, up 72%. But sequential growth slowed to just 3%, the weakest of the three.

What's Driving the Divergence

Amazon's strength comes from enterprise dominance and AI infrastructure scaling through Anthropic's Claude AI and custom Trainium chips. Google's acceleration reflects its Gemini AI platform and data analytics leadership, transforming it into the fastest-growing hyperscaler. Microsoft's slower pace signals market maturity rather than weakness, as Azure remains deeply embedded in enterprise IT systems.

Despite slower growth, Microsoft trades at the highest valuation multiple, pricing in long-term strength through Copilot, Office 365, and Azure OpenAI Service. But as Google and Amazon expand faster, that premium faces pressure. The data reveals a shifting hierarchy: Google breaking out as a growth leader, Amazon maintaining scale dominance, and Microsoft's curve flattening. The cloud race is moving from expansion to differentiation through AI capabilities and custom infrastructure.

Usman Salis

Usman Salis

Usman Salis

Usman Salis