The AI revolution is reshaping tech investment patterns, and new data from Morgan Stanley Research reveals an interesting dynamic: not all chip makers are positioned equally. While giants like Nvidia and Microsoft navigate complex webs of vendor financing and credit extensions, AMD appears to have carved out a remarkably clean path forward - one defined by capital inflows without the burden of corresponding outflows.

AMD's Unique Position in AI Capital Flows

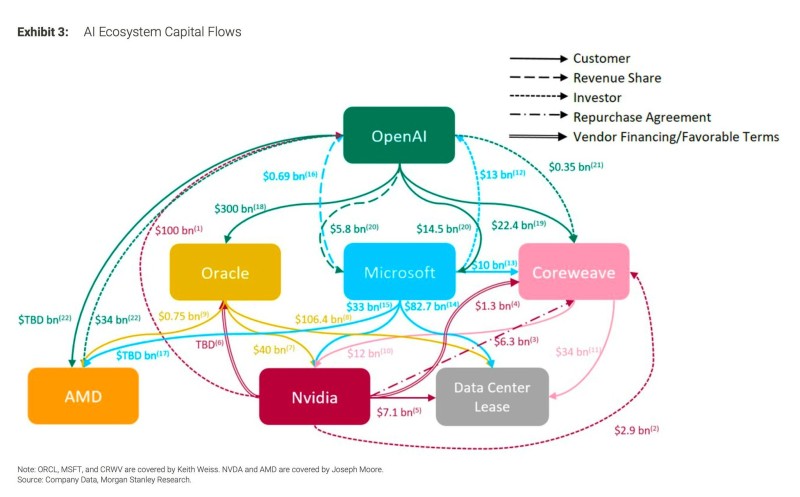

Market analyst Oguz O. recently highlighted a crucial distinction in how money moves through the AI ecosystem. Microsoft, Nvidia, and Oracle sit at the center of massive bidirectional capital flows - simultaneously pouring billions into partnerships while receiving substantial investments.

Microsoft funnels money into OpenAI and data center deals, Nvidia has committed over $40 billion in vendor financing, and Oracle manages more than $100 billion in total exposure. AMD's situation looks fundamentally different. The company benefits from investment inflows without needing to extend credit lines or offer vendor financing, creating a structurally cleaner balance sheet in the AI race.

The Morgan Stanley chart shows $82.7 billion flowing through Microsoft's ecosystem, $40 billion tied to Nvidia's financing, and $106.4 billion in Oracle-related exposure. AMD sits in a category of its own - inflows with no outbound obligations. This means the company can build its AI business without the financial complexity that comes with supporting customer liquidity.

What This Means for Profitability

AMD's clean capital structure creates tangible advantages. Without vendor financing draining resources, the company keeps more of what it earns, leading to potentially higher margins. It also avoids risks that come with large credit commitments - if customers face trouble, AMD isn't exposed. The timing works in its favor as it scales production while global AI adoption accelerates.

Looking Ahead

If AMD maintains this position, it could emerge as one of the most profitable players in AI hardware, potentially challenging Nvidia's leadership. As infrastructure spending climbs, the company's straightforward capital approach may prove more sustainable than competitors managing billions in complex financial arrangements. For investors watching the AI sector, AMD's capital flow profile signals operational efficiency and financial health that could deliver strong returns as the market matures.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah