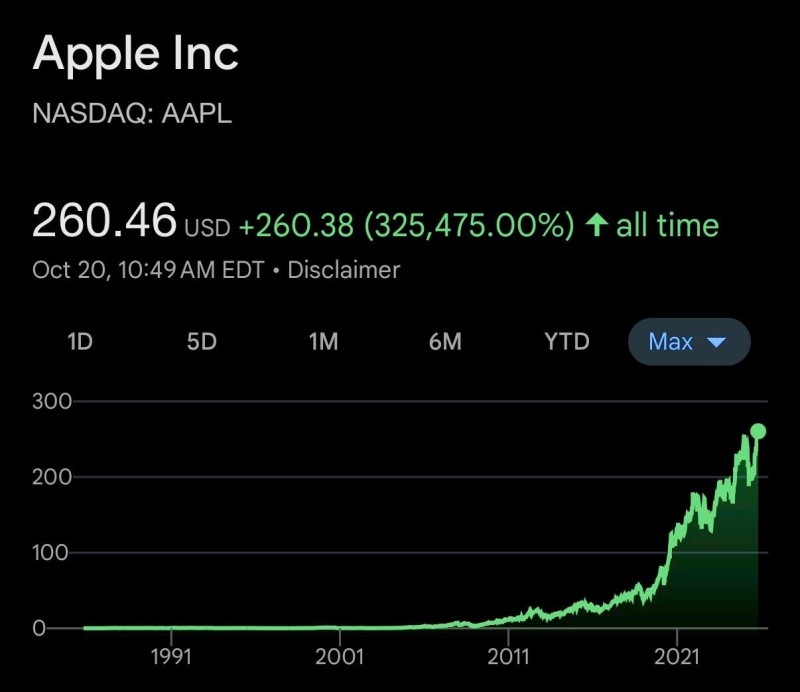

Apple (AAPL) stock has once again made headlines, climbing to an unprecedented $260.46 per share. This achievement highlights the company's remarkable journey from a modest tech startup in the late 1970s to a trillion-dollar innovation giant that continues to dominate global markets.

Stock Sharks Trader Highlights Historical Performance

The data, first brought to attention by Stock Sharks trader, reveals that Apple's total return since going public has reached an incredible +325,475%. The chart clearly shows how growth really took off in the early 2000s with the iPod's success, then accelerated dramatically after the iPhone launched in 2007.

Looking at the long-term chart, Apple's first two decades show relatively flat performance as the company worked through early challenges and leadership changes. The real breakthrough came after 2003, when revenue surged alongside the boom in consumer digital products. From 2011 to 2020, the stock saw multiple strong rallies followed by healthy pullbacks — typical of sustainable growth.

Currently, the chart shows solid support around $220–$230, where buyers consistently stepped in during corrections. With resistance above $250 now broken, Apple looks firmly positioned in a renewed uptrend. The smooth curve and lack of sharp reversals signal strong institutional backing and steady long-term investment.

What's Behind the Latest Rally

Apple's recent climb stems from solid fundamentals and forward-thinking innovation. The company keeps generating strong revenue from its services — iCloud, Apple TV+, and the App Store — while developing the next generation of AI-powered devices. Analysts note that investors see Apple as both a safe haven and a growth play, thanks to massive cash reserves and smart capital management. Despite supply chain issues and regulatory pressure, Apple's product demand and brand loyalty remain unbeatable.

What's Next for Apple

Trading near record highs, market sentiment stays positive. Analysts see potential gains toward $280–$300 over the next year if earnings keep beating forecasts and new AI products boost profits. That said, some caution makes sense. The company faces headwinds in China's smartphone market, regulatory scrutiny in the U.S. and Europe, and slower hardware upgrades. Still, Apple's diversified revenue — no longer relying heavily on iPhone sales alone — provides a strong cushion against economic ups and downs.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir