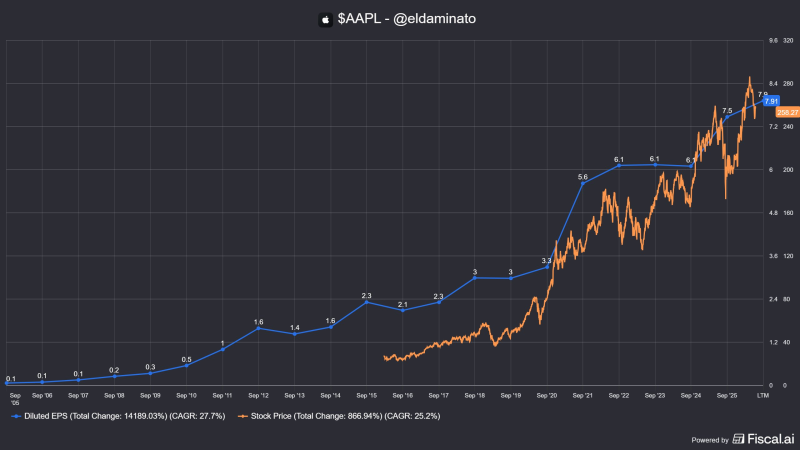

⬤ Apple just dropped some encouraging numbers for the quarter wrapping up in March, pointing to solid momentum across its main business lines. The company's looking at year-over-year revenue growth between 13–16%, with iPhone demand doing the heavy lifting. When you zoom out and look at the bigger picture, there's a clear pattern: diluted earnings per share have been climbing steadily right alongside the stock price through multiple market cycles.

⬤ Current projections put Apple's earnings per share at around $8.50 for this fiscal year, which closes out in September. That works out to annual EPS growth somewhere in the 14–16% range. Fast forward another year, and earnings could push past $9 per share if things keep tracking this way. The long-term view is pretty striking—EPS has jumped from roughly $0.10 back in the mid-2000s to nearly $8 on a trailing basis, tracking closely with how AAPL's share price has moved over time.

⬤ The scale here tells the story. Diluted EPS growth shows a total increase of over 14,000% across the period tracked, while the stock price gained more than 860% over that same stretch. This kind of alignment shows Apple's been converting earnings growth into real market value, backed by strong margins, serious free cash flow, and the kind of product ecosystem that's tough for competitors to crack.

⬤ Why this matters beyond Apple: the company's still a key barometer for big tech and overall market sentiment. When Apple gives clear visibility on revenue and earnings, it helps set the tone for valuation expectations and sector leadership. With Apple showing this kind of durable demand and earnings strength, its outlook gives investors a solid reference point for judging growth resilience among mega-cap names as we move through the fiscal year.

Peter Smith

Peter Smith

Peter Smith

Peter Smith