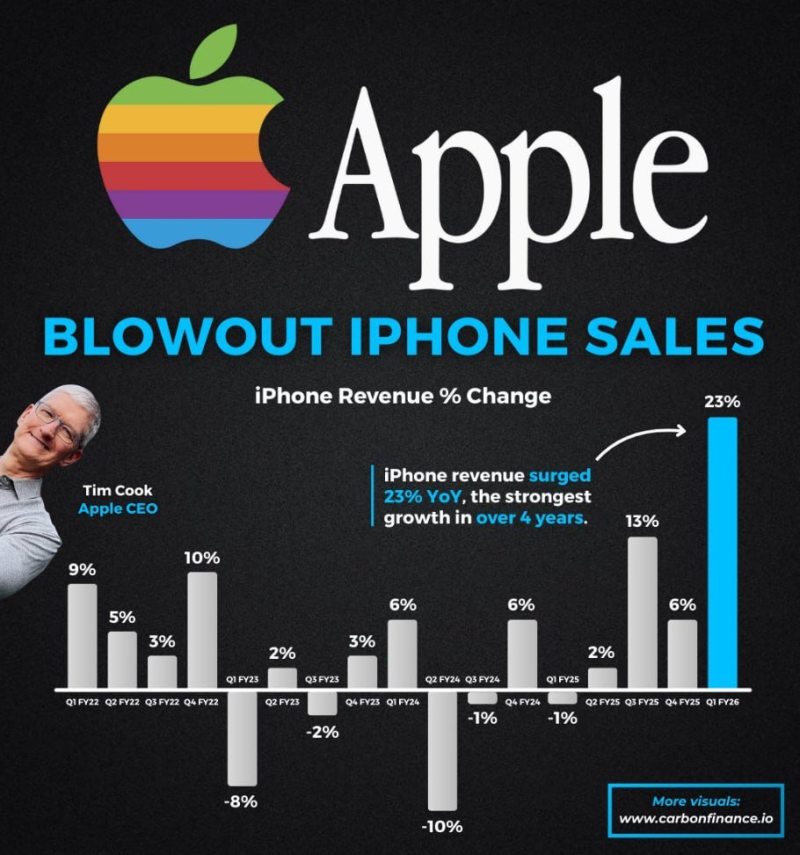

⬤ Apple just posted its best iPhone quarter in years, with revenue climbing 23% year over year to reach $85.3 billion in Q1 FY2026. This marks a dramatic turnaround for the flagship product line, which had been struggling with weak growth and outright declines for much of the past four years.

⬤ The latest numbers show a clear break from the pattern that defined Apple's recent iPhone performance. Previous quarters were characterized by low single-digit growth at best, with several periods dipping into double-digit declines. The 23% surge represents the strongest quarterly growth since at least 2021, signaling what looks like a genuine inflection point rather than just another incremental bump.

⬤ What makes this quarter particularly notable is the contrast with what came before. After years of flat or negative readings, iPhone revenue didn't just tick up slightly—it broke out decisively. The $85.3 billion quarterly total reflects a meaningful shift in momentum, not just a marginal improvement driven by seasonal factors.

⬤ For the broader market, this matters because the iPhone remains the core engine of Apple's business and a bellwether for big tech trends. When iPhone sales accelerate like this, it tends to lift expectations around earnings power and sector leadership. The data shows Apple can still drive real growth in its most important product line, and that typically has ripple effects across technology and consumer markets.

Peter Smith

Peter Smith

Peter Smith

Peter Smith