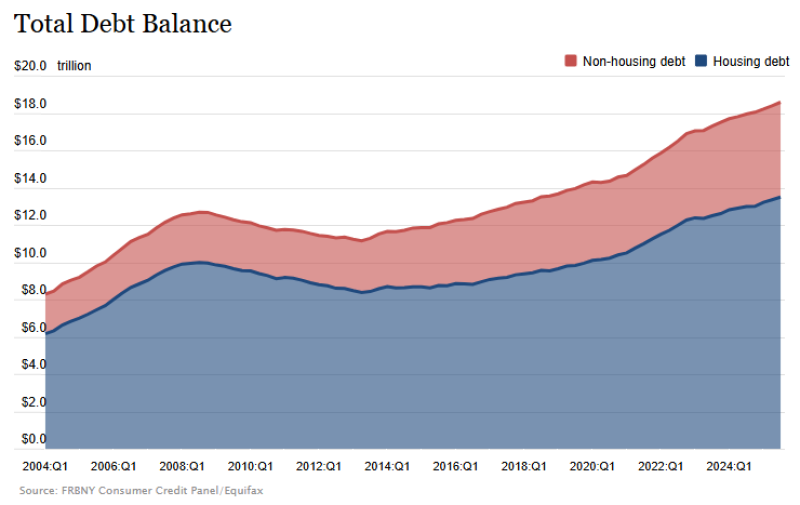

● According to a recent post by Barchart, fresh data from the New York Fed's Consumer Credit Panel reveals that total U.S. household debt has hit a record $18.59 trillion. The figure reflects mounting financial pressure on American families as inflation, high interest rates, and rising costs push borrowing to unprecedented levels.

● The spike comes from two main sources: housing and everyday spending. Mortgages still make up the biggest chunk of what people owe, but non-housing debt—credit cards, car loans, student loans—has jumped sharply since 2020. Economists are concerned that if rates stay high, we'll see more missed payments and defaults, especially among households already dealing with depleted savings and flat wages.

● This debt pile creates problems for both families and policymakers. People are still spending, but much of it's funded by loans rather than actual income growth. Analysts estimate that over $1 trillion of the increase since 2022 has come from non-housing credit alone. If interest rates don't come down or wages don't pick up, this debt burden could eventually choke off spending and slow economic growth.

● While the debt-to-GDP ratio is still below 2008 crisis levels, today's expansion looks different—it's less about housing bubbles and more about credit cards and personal loans. That growing reliance on unsecured debt points to a fragile balance between resilience and risk. Some experts think this trend could force the Fed to consider cutting rates if delinquencies keep climbing into 2025.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah