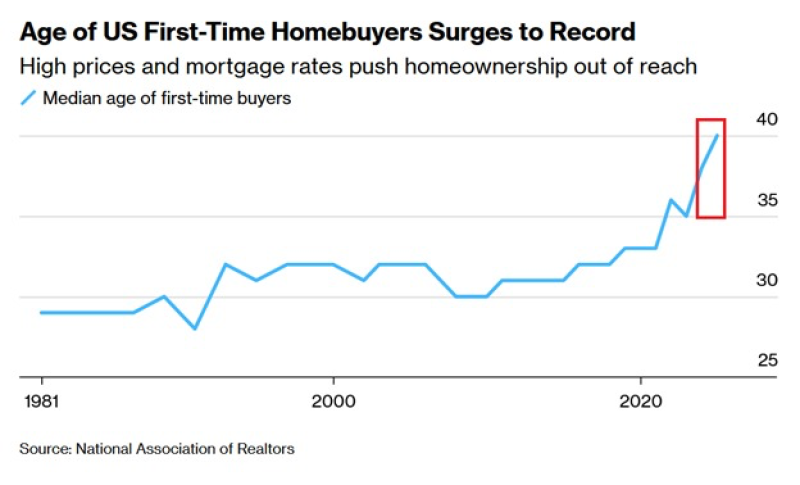

● According to Stock Sharks, new data from the National Association of Realtors shows the median age of first-time homebuyers has hit an all-time high of 40. That's a sharp jump from just a few years ago, reflecting how expensive and out of reach homeownership has become.

● Younger Americans are facing serious financial hurdles. Home prices keep climbing, inflation isn't letting up, and mortgage rates have more than doubled since 2021. The result? Buying a home feels impossible for many. Housing analysts worry this could widen wealth gaps since homeownership has always been a key way to build long-term wealth. There's a real risk of creating a "lost generation" stuck renting longer than they'd like.

● This shift affects more than just individual buyers. First-time buyers usually make up about a third of home sales, but that number's dropping. Real estate agents and builders are now targeting older, wealthier buyers who can put down bigger deposits or pay in cash. Economists say this could slow down the housing market overall and hurt spending on everything from construction materials to appliances and furniture.

● This trend points to deeper issues. Wages haven't kept pace with housing costs, and there simply aren't enough affordable homes available. Some policymakers are pushing for tax breaks and expanded buyer credits, but nothing's set in stone yet.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova