The consumer staples sector is experiencing an exceptional rally that's catching the attention of market analysts and institutional investors alike. In just five weeks, the sector has climbed nearly 17%, marking one of the most significant short-term gains in over three decades. This dramatic move isn't just about numbers—it's telling us something important about where smart money is heading right now.

17% Rally Puts Consumer Staples in Rare Historical Territory

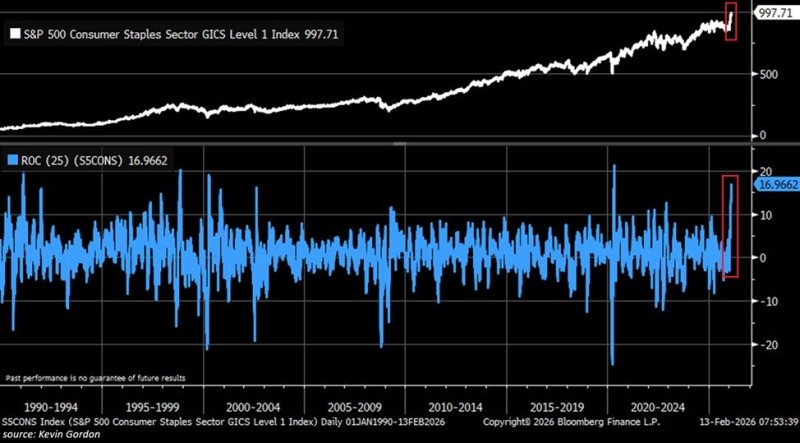

The S&P 500 Consumer Staples sector has surged approximately 17% in five weeks, delivering its strongest performance since the chaotic pandemic recovery of 2020. Only four stronger five-week advances have occurred since 1990. The momentum readings have spiked to levels rarely seen in historical data, with the chart showing the index pushing toward new highs.

As one market analyst noted, "The rate-of-change indicator shows one of the largest momentum spikes in decades, reinforcing that capital is moving rapidly into stability-oriented equities."

Record $3.6 Billion Inflows Signal Major Defensive Rotation

This isn't a gradual trend—it's aggressive repositioning. Fund flow data reveals investors poured roughly $3.6 billion into consumer staples stocks and ETFs over the past four weeks. The four-week average of net inflows hit approximately $912 million, a staggering jump from the prior 52-week average of just $7 million.

These numbers represent more than routine rebalancing. They indicate institutional capital is flooding into defensive positions at a pace we haven't witnessed in years.

What Historical Patterns Tell Us About This Rally

Similar explosive bursts in consumer staples occurred during pivotal market moments: February 1991, November 1998, April 2000, and April 2020. Each instance coincided with significant market uncertainty or transitions. The current momentum spike ranks among the largest in decades, comparable to sector rotation patterns during corrections.

Why Investors Are Rushing Into Defensive Stocks Now

The rapid shift toward consumer staples reflects changing expectations about broader market conditions. When capital moves this aggressively into defensive sectors, it typically signals heightened concern about economic growth, interest rates, or equity valuations in more cyclical areas.

Consumer staples companies—think household goods, food, and beverages—tend to maintain stable earnings regardless of economic conditions. They're the stocks investors buy when they want exposure to equities but need protection from volatility.

This defensive rotation highlights increased sensitivity to macro sentiment. As equity leadership shifts, the market is essentially voting with its dollars, choosing stability over growth—at least for now.

Usman Salis

Usman Salis

Usman Salis

Usman Salis