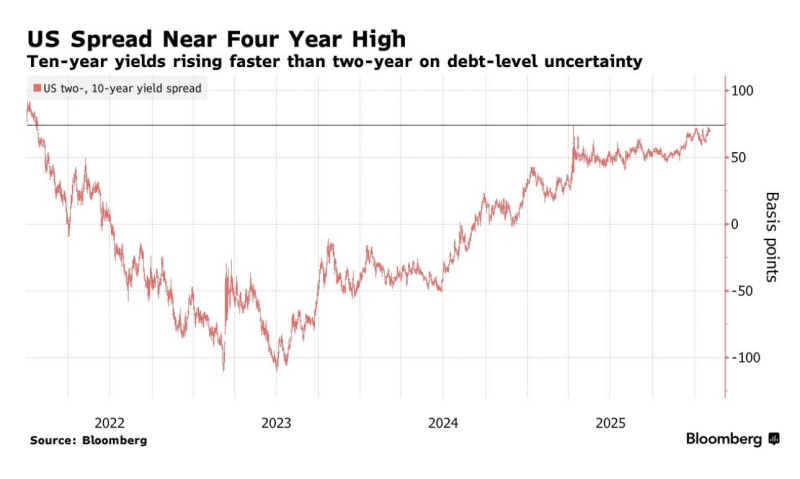

⬤ The U.S. yield curve is getting steeper, and it's happening fast. The spread between two-year and ten-year Treasury yields is now sitting near 69 basis points—approaching the four-year high of 74 basis points hit back in April 2025. Throughout 2024 and into early 2026, longer-dated yields have been climbing faster than their short-term counterparts, marking a clear shift in market dynamics. Investors are now paying close attention to the Treasury's quarterly bond sale announcements, which could reveal just how much new debt is coming to market.

⬤ Just last week, this spread was hovering around 61 basis points. That means we've seen a jump of roughly 8 basis points in a matter of days—a notable move that signals changing investor sentiment. The curve, which was inverted not too long ago, has now swung in the opposite direction. It's steepening at a pace that's caught the attention of bond traders and analysts alike.

⬤ What's really driving this shift is the ten-year yield, not the two-year. Long-term rates are rising because investors are demanding more compensation for holding bonds that mature further out. As one market observer noted, "The focus has shifted toward the Treasury's upcoming quarterly bond sale plans, which are expected to provide fresh insight into future government issuance." Translation: people want to know how much debt the government plans to sell, and they're pricing in that uncertainty now.

⬤ Why does this matter? Because the shape of the yield curve tells us a lot about what investors expect from the economy and fiscal policy. A steeper curve typically means markets are bracing for higher long-term borrowing costs, which can ripple through everything from mortgages to corporate bonds. With the 2Y–10Y spread closing in on multi-year highs, all eyes are on Treasury issuance plans and whether demand can keep pace with supply.

Peter Smith

Peter Smith

Peter Smith

Peter Smith