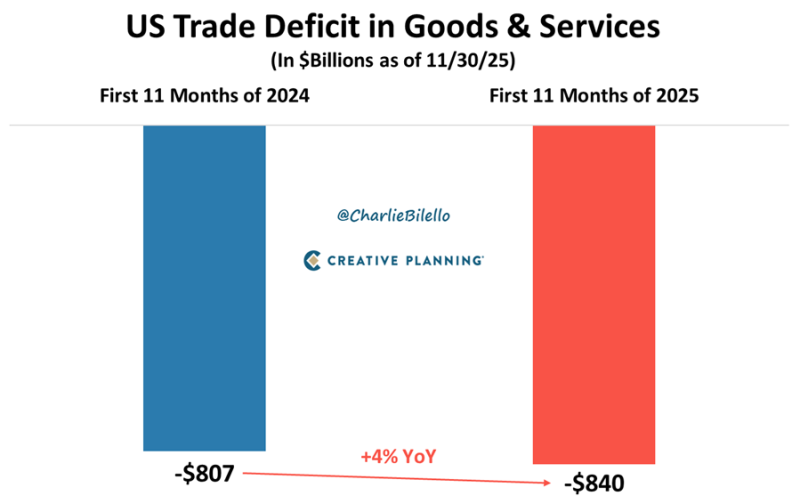

⬤ The US trade deficit climbed to $840 billion over the first 11 months of 2025, up from $807 billion during the same stretch in 2024. That's a 4% jump based on figures running through November 30. The numbers show a clear widening of the gap between what America buys from abroad and what it sells overseas.

⬤ Trade patterns this year got messy because businesses scrambled to get ahead of tariff changes. Companies loaded up on imports during the first quarter, building stockpiles before new trade restrictions landed. This early buying spree pushed the deficit higher right out of the gate. After that initial rush, firms spent the rest of the year working through those inventories, which brought import volumes back down and slowed how fast the deficit was growing.

⬤ The year's data tells a story more about timing than actual consumption shifts. Even though imports cooled off after Q1, that early inventory binge kept the overall deficit elevated compared to 2024. The pattern points to inventory management driving the numbers rather than any real change in how much Americans are buying or how competitive US exports have become.

⬤ These trends matter for markets because trade balances affect GDP calculations, supply chain planning, and inflation. When companies stockpile goods early, tariff costs don't show up right away—they hit later when those inventories need restocking. Until trade flows get back to normal, the deficit numbers will keep reflecting old positioning moves instead of current demand, making the economic outlook harder to read.

Usman Salis

Usman Salis

Usman Salis

Usman Salis