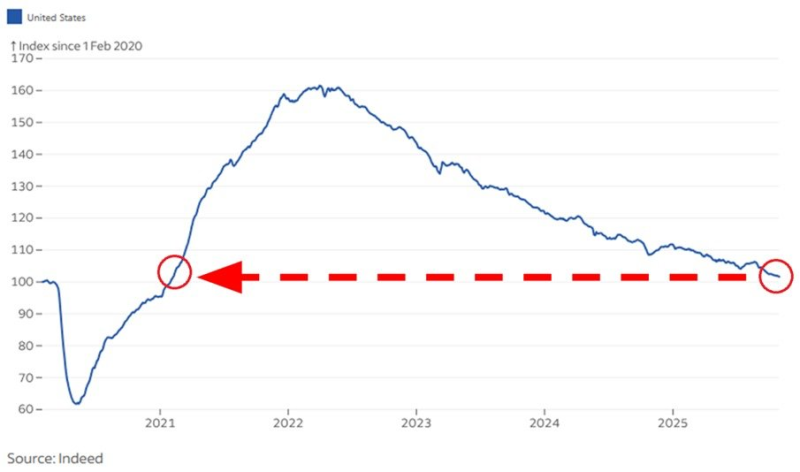

⬤ Labor demand continues to weaken, with Indeed's postings index returning to early 2021 levels. The 6.4% year-over-year decline marks the lowest point since February 2021, with weakness spreading across the broader labor market.

⬤ From their April 2022 peak, postings have plunged 36.9%. Indeed's chart shows a sharp climb through 2021–2022 followed by a sustained decline. Total postings are now only 1.7% above February 2020 levels, while new postings are just 4.1% higher—meaning the post-pandemic hiring surge has essentially been erased.

⬤ This trend suggests more weakness ahead in official BLS job openings data, which has been delayed by a government shutdown. The current readings have returned to pre-pandemic territory, confirming a material softening since the 2022 highs.

⬤ For investors, these numbers matter. Declining job postings often signal shifts in broader employment trends and economic activity. With postings hovering near early-2021 levels and barely above pre-pandemic benchmarks, cooling labor demand could reshape expectations around growth, corporate earnings, and interest rates. Once the delayed BLS data is released, it should confirm whether Indeed's index is accurately capturing the direction of the labor market.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah