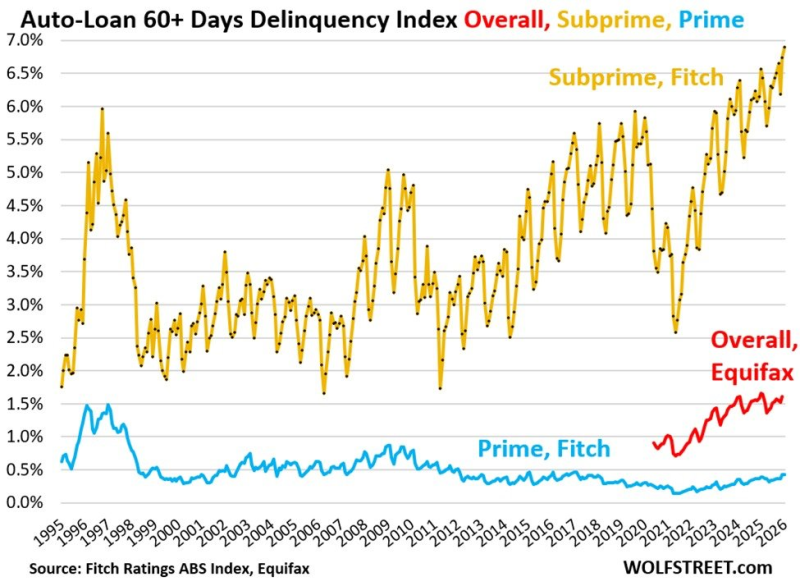

American consumers are struggling to keep up with their car payments at rates not seen in decades. New data reveals that subprime auto loan delinquencies have reached an all-time high, surpassing even the levels witnessed during the 2008 financial crisis. With total auto debt ballooning to $1.67 trillion, the widening gap between prime and subprime borrowers paints a concerning picture of financial strain across different economic segments.

Subprime Auto Delinquencies Reach Historic Peak

Recent U.S. consumer credit data shows serious repayment trouble in the auto loan market. According to The Kobeissi Letter, the 60+ day delinquency rate on subprime auto loans has jumped to a record 6.9%. This figure sits 0.9 percentage points above the previous 1996 peak and significantly exceeds the roughly 5.0% rate seen during the 2008 financial crisis.

The numbers tell a stark story: serious delinquencies have more than doubled since 2021. Meanwhile, total auto loan balances grew by approximately $312 billion over the past five years, reaching $1.67 trillion - driven largely by soaring vehicle prices. These trends mirror broader consumer debt patterns emerging across multiple credit categories.

Growing Gap Between Credit Tiers

Subprime loans currently make up about 14% of total auto borrowing, representing roughly $234 billion. While prime borrowers continue managing their payments relatively well, the divide between credit tiers keeps expanding.

As The Kobeissi Letter noted: The divergence between prime and subprime borrowers underscores how changes in debt levels and repayment capacity can evolve differently across segments of the consumer credit market.

This widening gap reflects similar dynamics seen in credit card delinquencies, where subprime borrowers face disproportionate financial pressure.

Broader Consumer Credit Concerns

These auto loan troubles aren't happening in isolation. Similar patterns of household repayment pressure have emerged across consumer credit categories, as detailed in recent analysis of credit card recovery trends.

The surge in missed payments on secured consumer credit highlights how unevenly economic conditions are affecting different borrower groups. While some Americans navigate higher costs successfully, others face increasing difficulty meeting basic debt obligations.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi