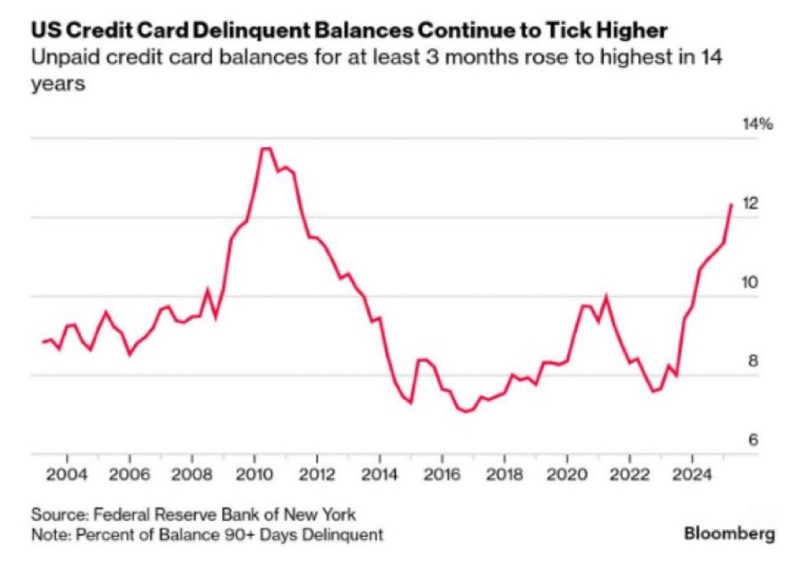

A troubling trend is emerging across the American economy. Unpaid credit card balances overdue by at least 90 days have reached their highest level in 14 years, according to Federal Reserve Bank of New York data. This surge suggests that household finances, which helped stabilize the post-pandemic recovery, are now buckling under the combined pressure of expensive credit and stubborn inflation.

Chart Analysis: Delinquencies Accelerate at the Fastest Pace Since 2009

According to trader analysis from Barchart citing Bloomberg sources, the chart reveals a sharp uptick in credit card delinquencies, now approaching 12% — a level not seen since the 2008 financial crisis aftermath.

After roughly a decade of relative calm, the delinquency rate started climbing in 2022 and has continued rising through 2024 and into early 2025. The steepness of this increase mirrors the rapid ascent between 2007 and 2010, when household defaults spiked during the credit market collapse. But there's a key difference: today's stress stems less from job losses and more from the cost-of-living crunch. Consumers are simply running out of financial cushion as debt servicing costs climb higher.

Key Drivers: Inflation, Interest Rates, and Eroding Savings

Several economic forces are colliding to push delinquencies upward. The average US credit card interest rate now tops 22%, an all-time high, making it increasingly expensive to carry balances month to month. Core consumer prices remain stubbornly elevated, forcing more Americans to lean on revolving credit just to cover essentials.

Meanwhile, the pandemic-era savings buffers that many households built up have largely evaporated, leaving people exposed to even minor financial bumps. Younger borrowers between 18 and 29 are particularly vulnerable, showing the fastest growth in overdue balances due to less stable incomes and greater exposure to variable-rate debt. Without relief from the Federal Reserve, analysts warn that delinquency rates could reach levels last seen during the 2009 recession, when they peaked near 13%.

Economic Impact and Market Consequences

Though still below crisis-era peaks, the speed of this decline is raising red flags for both lenders and policymakers. Banks may tighten their lending standards in response, making it harder for consumers to access new credit and potentially dampening spending, which drives much of US economic growth.

The stress is also beginning to show up in auto loans and personal credit markets, suggesting this isn't an isolated problem. If this pattern continues, rising defaults could translate into weaker retail sales, slower job growth, and increasing investor skepticism about the strength of consumer demand, which remains the backbone of the American economy.

Usman Salis

Usman Salis

Usman Salis

Usman Salis