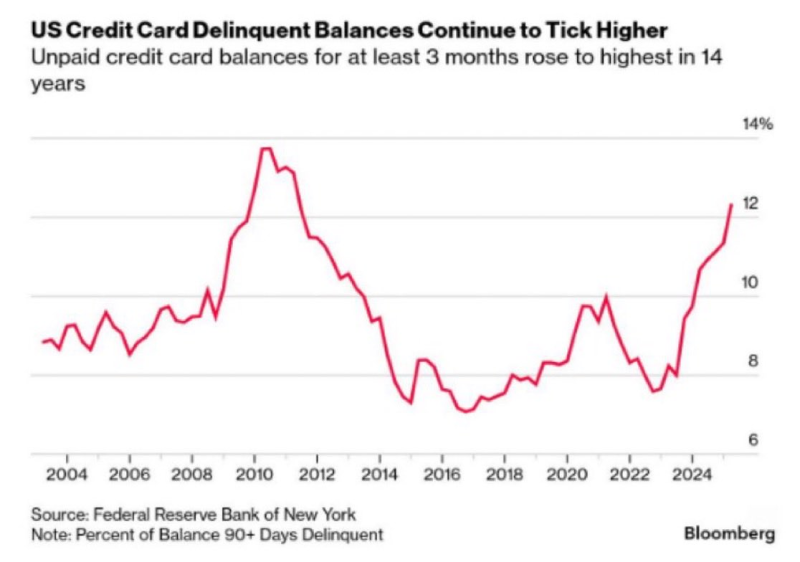

● Recent data from the Federal Reserve Bank of New York shows a troubling trend: serious credit card delinquencies have hit levels not seen since 2010. According to Stock Sharks, who shared the Fed's findings, accounts that are 90 days or more overdue now represent about 12% of total balances.

● This spike comes at a particularly tough time for American families. Credit card interest rates have climbed above 20% on average, making it harder for people to pay down their balances. The post-pandemic savings cushion that many households relied on has largely disappeared, leaving consumers more vulnerable to everyday costs like rent, groceries, and healthcare.

● The ripple effects could be significant. Major banks like JPMorgan Chase, Bank of America, and Capital One will likely need to set aside more money to cover potential defaults, which could hurt their bottom lines. At the same time, they may tighten lending standards, making it harder for people—especially those with lower incomes—to access credit when they need it most.

● This matters beyond individual households. When people carry heavy debt loads, they tend to cut back on spending, which can slow economic growth. Some economists are calling for interventions like temporary interest relief or debt restructuring programs to prevent the situation from spiraling.

● If delinquency rates keep climbing into 2026, experts warn we could see a negative cycle: stricter lending, reduced consumer spending, and slower GDP growth feeding into each other. What started as a personal finance problem could become a broader economic challenge.

Usman Salis

Usman Salis

Usman Salis

Usman Salis