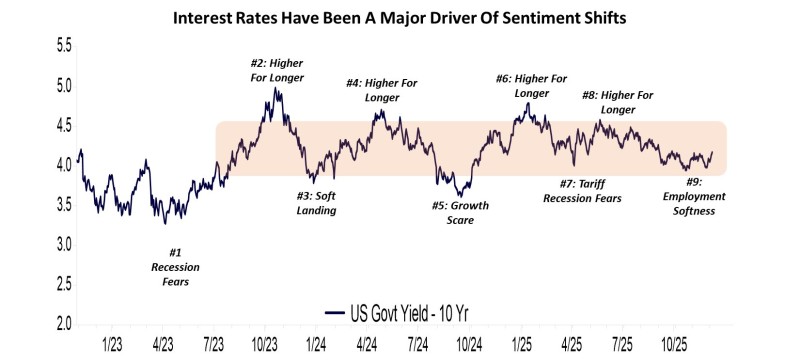

⬤ The direction of the US 10-year Treasury yield has been one of the hottest debates among traders and investors. Looking at the chart data since 2023, it's clear that every major move in the 10Y yield has lined up with noticeable shifts in how the market feels—whether people are worried about recession, betting on a soft landing, or freaking out about growth slowing down. Beyond the AI stocks that seem to live in their own world, interest rate changes have been the biggest force moving equities around.

⬤ The data shows several distinct phases where yields climbed higher under the "higher-for-longer" story, only to pull back when recession fears or growth scares kicked in. These swings show how traders have been reacting to the constant flow of economic data—inflation numbers, government spending patterns, and job market signals. Despite all the bold predictions calling for either a massive spike in yields due to ballooning deficits or a sharp crash from weak employment, neither has actually happened. Instead, rates have mostly stayed stuck in a range.

⬤ One theme that keeps popping up is the K-shaped economy, which has made markets incredibly sensitive to rate movements. When economic data comes in strong, yields tend to jump higher temporarily. When the data disappoints, yields drop back down. The chart marks all these sentiment swings—soft landing hopes, growth worries, tariff-driven recession fears, and employment weakness. These episodes have particularly hit equity breadth hard, especially outside the AI sector that continues to dominate headlines.

⬤ Why does this matter for your portfolio? Because elevated interest rates create real headwinds for stocks. The chart shows that the US 10Y yield has stayed relatively high compared to previous cycles, which means every new piece of economic data will keep jerking both yields and market sentiment around. This range-bound behavior tells us that markets will remain hypersensitive to macro developments, keeping interest rates front and center as the main driver of overall market conditions.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi