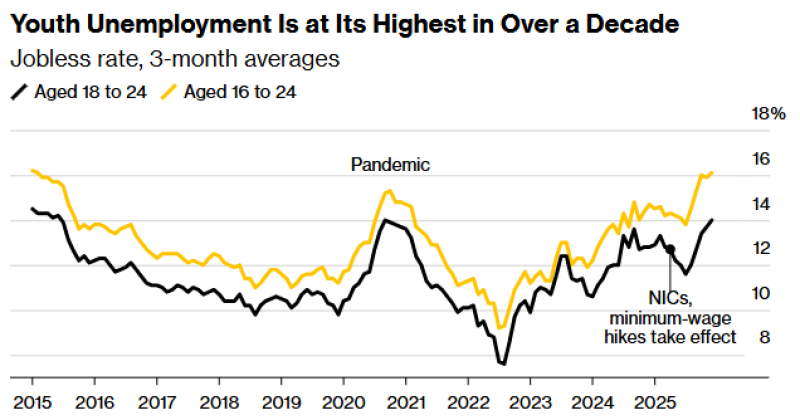

⬤ Youth unemployment in the UK has risen to 16.1% — the highest reading for workers aged 16 to 24 since 2014. Close to one million young people are currently out of education, employment, or training. The trend line tells a clear story: after touching post-pandemic lows, joblessness among young workers has been climbing steadily. UK labour market shows signs of slowdown.

⬤ Economists point to a mix of policy shifts and structural pressures. Minimum wage increases pushed pay for workers aged 18 to 20 to £10.85 per hour — above the inflation rate — while payroll tax changes and tighter hiring regulations appear to be making employers more cautious about entry-level roles. Automation and artificial intelligence are adding to that pressure, quietly displacing the kinds of jobs that younger workers typically fill first. Rising unemployment pressures Bank of England outlook.

Nearly one million young people are currently not in education, employment, or training — and the chart shows no sign of reversal yet.

⬤ The gap between age groups is widening. While older workers have seen relatively stable employment, young people are bearing the brunt of these market shifts. The government has responded with apprenticeship schemes, tax incentives for employers, and a £1.5 billion Youth Guarantee programme — but critics argue the numbers on the ground haven't moved in the right direction yet. Economic growth concerns weigh on GBP sentiment.

⬤ For currency traders, rising youth unemployment is more than a social indicator — it's a signal about the broader health of the UK economy. When early-career workers stay on the sidelines, consumer spending softens, household confidence drops, and the Bank of England faces a trickier balancing act between supporting growth and managing inflation. Policymakers are watching closely, but the trend has yet to turn.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi