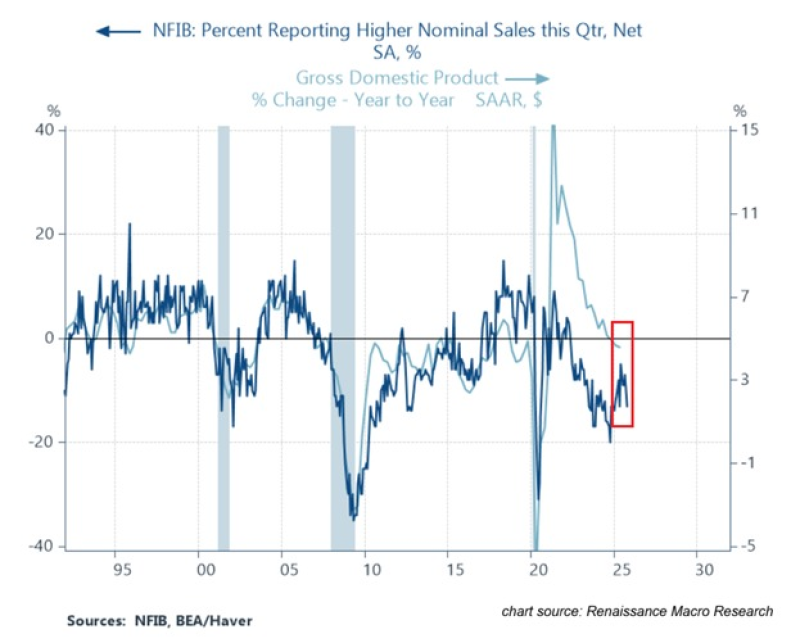

⬤ The latest NFIB Small Business Survey shows a clear deterioration in activity, with small business owners reporting higher nominal sales dropping by six percentage points in October to -13%. This marks the lowest reading since January and the 41st consecutive negative month. The indicator has stayed firmly below zero, reflecting widespread pressure on small firms across the country.

⬤ The data shows a strong historical connection between NFIB sales trends and year-over-year nominal GDP movement. The ongoing weakness in the NFIB series matches the visible decline in GDP growth, confirming that this metric often acts as a leading indicator. With most small firms now reporting lower nominal sales, the data points to broader economic cooling and suggests hiring may slow as businesses face softer demand.

⬤ Small businesses hold a major role in the U.S. economy. According to the U.S. Small Business Administration, these firms employ 45.9% of American workers and generate 43.5% of GDP. The 41-month negative streak in the NFIB survey signals more than isolated weakness—it shows a broader shift toward deceleration in the sector most sensitive to household demand and cost pressures.

⬤ The persistent decline in NFIB data matters because it reflects mounting pressure across a large portion of the U.S. economic base. Continued drops in nominal sales can influence spending patterns, employment decisions, and broader market sentiment. The combination of long-running survey weakness with easing GDP momentum suggests domestic economic activity may be entering a softer phase, shaping growth expectations for the coming months.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova